Preparing for Payday Super: Get ready for

1 July changes

Get our top resources and practical guidance to help you prepare for the new rules.

What is Payday Super?

Payday Super changes how and when you pay Super to employees. With the new changes coming into effect, Super must now be paid at the same time as wages, regardless of whether you run payroll weekly, fortnightly, or monthly. For payroll teams, this is a big shift for your day-to-day payroll operations

–and now is the best time to prepare.

Payday Super Key Dates

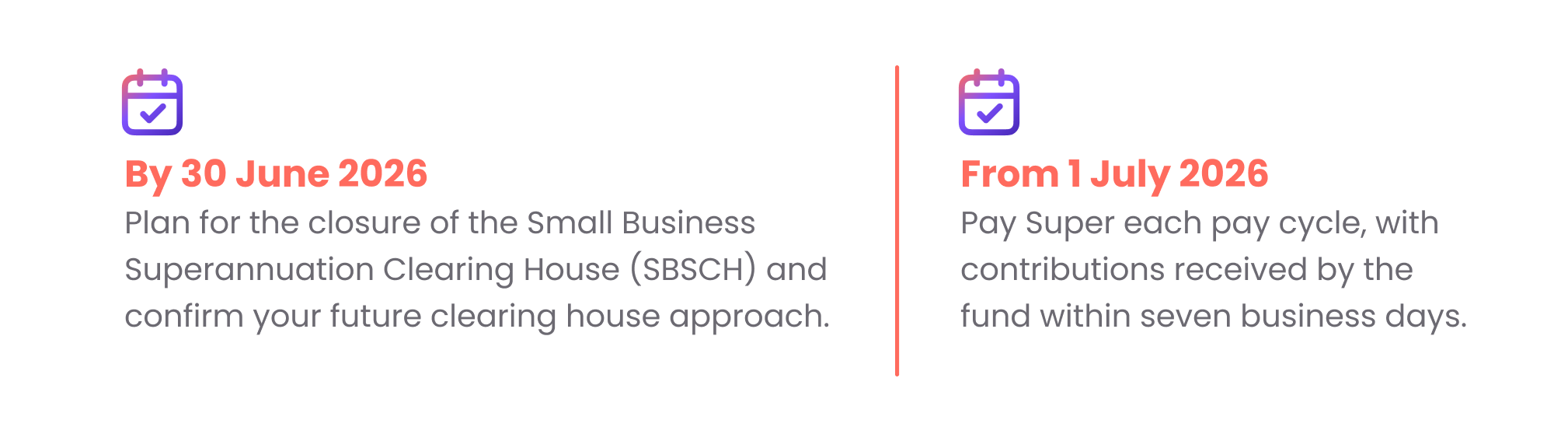

Get Payday Super ready by reviewing your current payroll process and staying up to date with ATO on timelines and changes.

3 things your payroll team needs to know

1. More frequent Super payments

You’ll need to move from quarterly to pay-cycle Super.

Weekly payers: 48 extra Super payments per year

Fortnightly payers: 22 extra Super payments per year

Monthly payers: 8 extra Super payments per year

2. Tighter timeframes

Super contributions must be paid to the employee’s fund at the same time you pay qualifying earnings (QE), on payday—within 7 business days. Shorter timeframes mean payroll teams have less room for errors, delays, and messy, manual processes.

3. Ongoing cash flow management

Finance teams must move from a quarterly Super accrual model to a weekly/fortnightly disbursement model, with funds having to be readily available every payroll cycle.

Don’t forget your clearing house

From 30 June 2026, the ATO’s Small Business Superannuation Clearing House (SBSCH) will no longer be available—that means you’ll need to find a new solution that’s integrated with your payroll system to manage the new Payday Super requirements.

You’ll want to look for a solution that:

Connects Super payments to your payroll cycle

Supports SuperStream 2.0

Reduces your reliance on manual reconciliation (and helps reduce errors)

Gives you clear, real-time visibility into things like refunds or bounce-backs

Payday Super FAQs

- When does Payday Super start?

Payday Super starts on 1 July 2026. From this date, employers will be required to pay employees’ super at the same time as wages, rather than quarterly. Preparing early gives businesses more time to understand the changes and adjust payroll processes with confidence.

- Do I still have until the end of the quarter to pay super?

No. From 1 July 2026, super must be paid on payday. The current quarterly payment option will be replaced, meaning super contributions need to be paid at the same time as employees are paid. This change is designed to align super with payroll to strengthen retirement savings and tackle unpaid super.

- Do I still pay super on Ordinary Time Earnings (OTE)?

No. Under Payday Super, the new base for calculating Superannuation Guarantee (SG) is Qualifying Earnings (QE) instead of OTE. QE includes all commissions and some additional salary sacrifice amounts as well as all Ordinary Time Earnings. It also may include payments to some contractors so it’s important to review what counts as qualifying earnings for each worker. Updating payroll systems ensures super is calculated correctly every pay run.

- What happens if I miss a super payment?

Under Payday Super, late or unpaid contributions can trigger the Superannuation Guarantee Charge (SGC), which includes the outstanding super, interest, and an administration charge. Paying super on time each pay run helps avoid these costs and keeps you compliant.

- How quickly does super need to be received by the employee’s super fund?

Super payments must reach the employee’s super fund within 7 business days of payday. This makes it important to run payroll accurately the first time, any bounced or reprocessed payments could delay super reaching employees on time. Using a payroll solution that has an embedded superannuation clearing house is key to on-time super.

- Do the Payday Super rules apply to casual or part-time staff?

Yes. Payday Super applies to all employees, including casual and part-time staff. Super entitlements must be paid on each payday, regardless of hours worked or employment type.

- How will PDS affect cash flow?

Payday Super can affect cash flow because super must be paid on each payday, not quarterly. This means funds need to be available more frequently, so planning ahead is important.

- How can Deputy Payroll help with Payday Super?

With Deputy Payroll, you can automate complex Super calculations with every pay run, while keeping wages and Super together in one place. Our platform helps you maintain records with clear audit trails. It’s the unified payroll platform designed for your shift-based business. Manage rostering, timesheets, pay runs, and Super in one place to help simplify compliance.

How Deputy can support your Payroll teams with Payday Super

With Deputy Payroll, you can automate complex Super calculations with every pay run, while keeping wages and Super together in one place. Our platform helps shift-based businesses maintain records with clear audit trails, while working seamlessly with your existing tools. It’s the all-in-one payroll solution.

Integrated payroll

Deputy Payroll makes it easy to connect timesheets, pay runs, and Super processes in one platform, helping reduce the burden of endless admin work (especially as payment frequency increases).

Clearing house support

With the upcoming SBSCH closure, you’ll need a unified payroll platform with clearing house functionality—and that’s where Deputy comes in.

Validation of super details

Deputy HR validates employee Super fund details during onboarding via SuperAPI. This avoids reprocessing, protects cash flow, and helps meet the 7-day window.

Clear, auditable records

Use Deputy Payroll to simplify payroll and help keep it accurate; digital payroll and Super records support reporting and reviews, so you’re ready if an audit arises.

Visibility into upcoming wages

With super moving to pay-run payments, cash flow visibility becomes essential. Deputy shows upcoming wage and super costs before each pay run, helping you plan ahead and avoid surprises.

Designed for shift-based payroll

Deputy is built for shift-based businesses, helping you automate complex pay rate calculations and reducing the manual work payroll teams have with variable hours and rosters.

Get Payday Super ready with Deputy

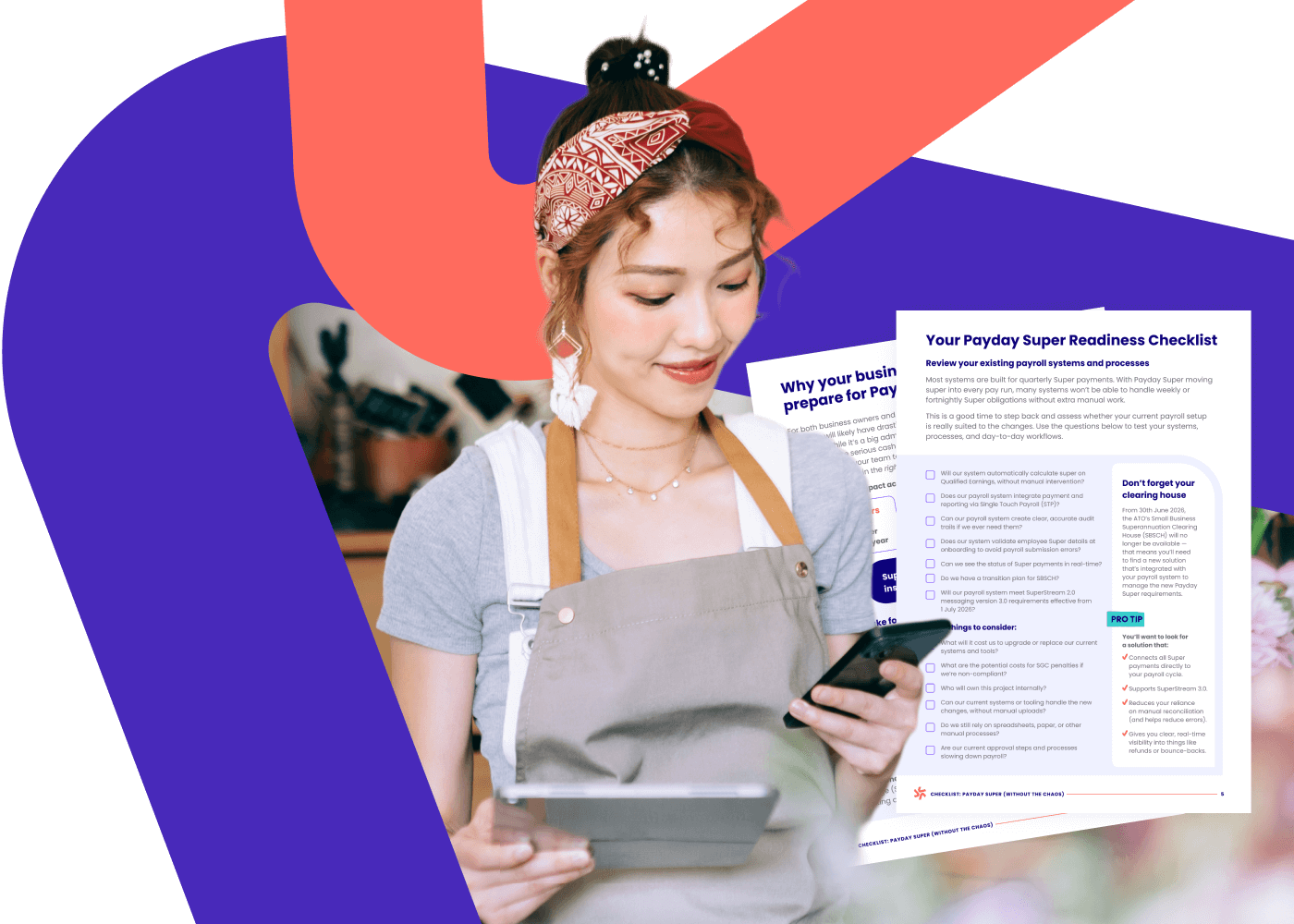

Payday Super Checklist

Download our practical checklist to help your payroll team review your processes, identify gaps, and prepare for Payday Super changes.

Prepare for Payday Super with Deputy

Payday Super means your business will have to make a big shift. Prepare now to have time to assess your options, select the best platform for your Payroll needs, and test multiple pay runs before launching on 30 June 2026.

That’s where Deputy Payroll comes in. It’s designed for shift-based businesses to help automate complex Super calculations with every pay run, while keeping wages and Super together in one place. Our platform helps you maintain records with clear audit trails, while working seamlessly with your existing tools.

Want to learn more about Deputy’s payroll and compliance tools? Book a demo with our experts today or start your free trial of Deputy.

PAYROLL OFFER

Get 2 free months of Deputy Payroll!

Deputy Payroll is designed for shift-based businesses managing frequent pay runs. As Payday Super adds to your payroll complexity, Deputy Payroll can help reduce errors and simplify your pay runs. Get 2 months free* when you choose an annual Deputy Payroll plan.

*Terms & conditions apply

More resources for Australian payroll teams

Deputy Payroll,

from timesheets to pay in seconds

Disclaimer: While Deputy's platform is designed to simplify shift work and payroll through automation, this document is for informational purposes only and does not constitute legal or financial advice. It is ultimately each customer's sole responsibility to pay their employees correctly and in compliance with all legal and regulatory requirements. Please review our Product Specific Terms for more information.