Rosters, timesheets, payroll—Easy as click, click, paid

The fast, easy way to run your team and payroll from one place.

Deputy makes it easier to run a shift based business from rostering to payroll

Streamline hiring, rostering and payroll with one easy-to-use app that hourly workers love.

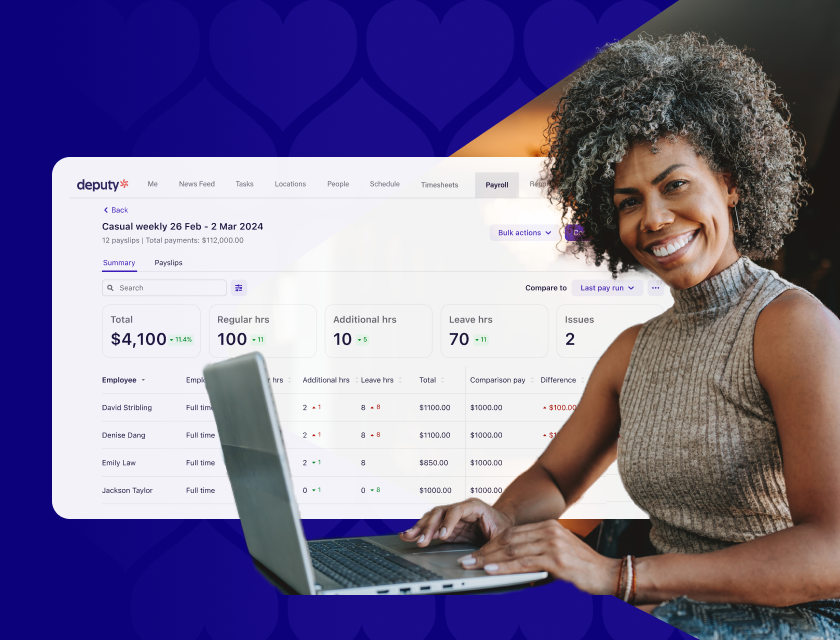

Streamlined, multi-entity payroll

Whether you’re new to running payroll or you’ve done it for years, we’ve got you covered. Deputy Payroll makes it easy to manage even the most complex pay situations.

Multi-entity

One login

Easy to use

5 Best Practices for Payroll

In this free ebook we take you through 5 key best practices to ensure that your payroll process is efficient, accurate and most importantly compliant.

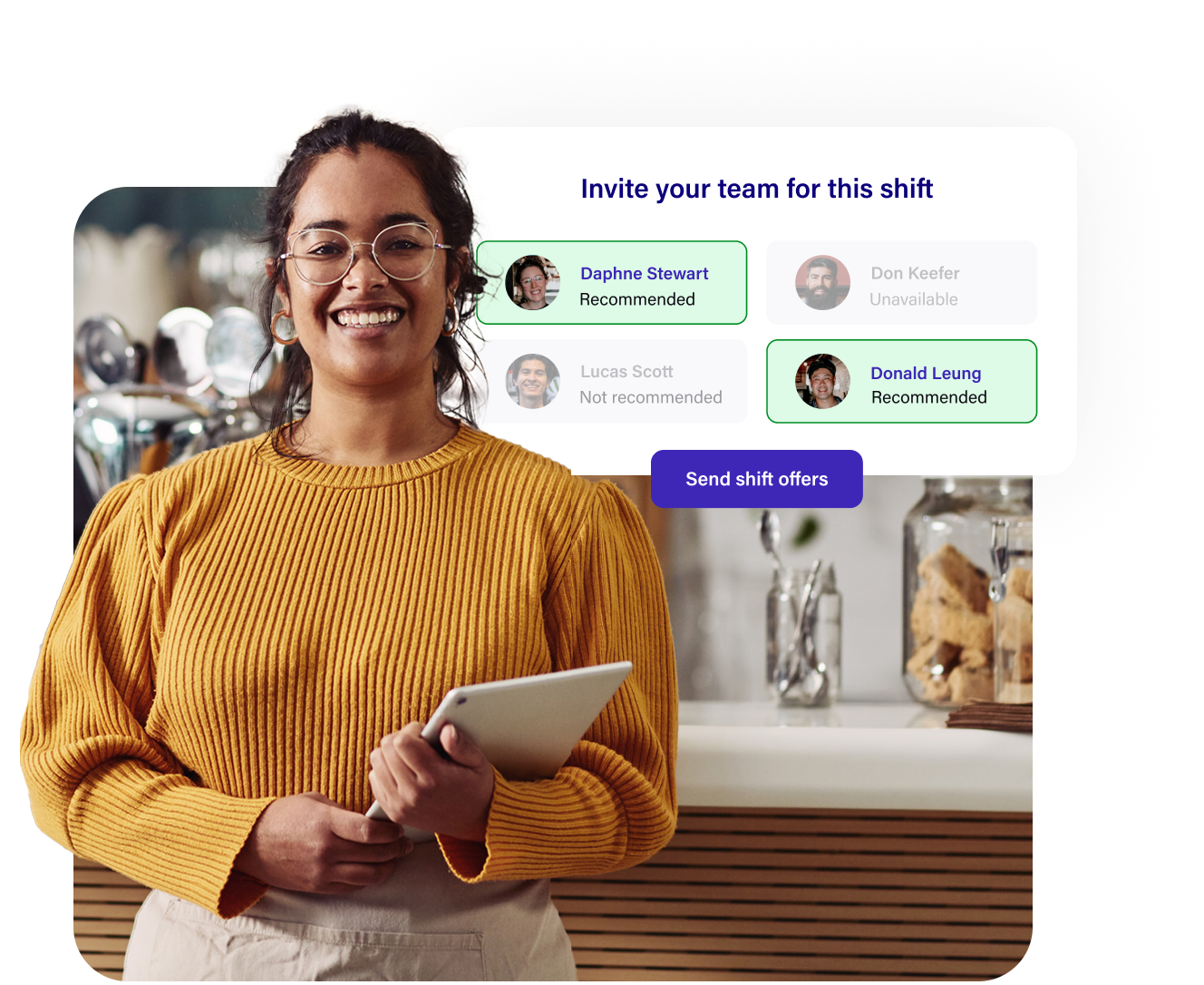

Smarter Rosters, Seamless payroll

Deputy brings your rostering and payroll together - so every break, shift and timesheet flows seamlessly - all in one place.

Take timesheets to payroll in a single click and run multi-entity pay runs with ease - all from the same place you create your rosters.

Find out how Deputy can help your business with a personalised demo or free trial

Explore the full range of Deputy solutions

See what our customers think

Frequently asked questions

- What is Deputy Payroll?

Deputy Payroll is the newest product soon to be released by Deputy, Australia’s favourite HR and workforce management platform. It is a completely integrated payroll solution, with a single log in, that takes approved timesheets through to payroll in zero clicks.

- How can I get started with Deputy Payroll?

For early access to try Deputy Payroll, you must have an active trial account. Start a free Deputy trial now for free payroll until the end of the financial year.

- Will I need a separate Deputy account to run payroll for my different business entities?

No — Deputy Payroll is a true multi-entity solution, so you can set up an unlimited number of payroll entities to be managed within the one Deputy account.

- Can Deputy Payroll be purchased separately?

Deputy Payroll is an ‘add-on’ product to our core workforce management solution. To learn more about Deputy Rostering and Timesheets, click here.

- Are Industry Awards automatically updated?

Deputy takes care to regularly review and update its Awards Library. Customers enjoy flexibility to use Deputy's interpretation of the modern awards, to customise them, or to create their own pay rules from scratch using Deputy's best-in-class Pay Rate Builder.

- Can employees update their own details?

Yes, we offer ‘Employee Self-Service” (ESS) which enables your team to update their personal details via the mobile app or on a desktop, helping to reduce repetitive admin requests.

- Is Deputy Payroll STP2 compliant?

Deputy Payroll is designed to support Single Touch Payroll Phase 2 (STP2) reporting requirements.

Compliance Responsibilities

While Deputy’s workforce management software is designed to simplify compliance with many scheduling and timekeeping requirements, it is not a substitute for payroll or legal advice, nor is it intended to relieve you of your obligation to comply with the laws and regulatory requirements that are applicable to your business. It is ultimately each customer’s sole responsibility to pay their employees correctly and in compliance with all legal and contractual requirements. Please review our Product Specific Terms for more information about your compliance responsibilities. The information provided on this website is for general informational and promotional purposes and is not payroll, legal, or tax advice.