The Best Strategies for Calculating Vacation Pay for Hourly Employees

There is nothing that your employees love more than to take time off for their vacation. However, as a business owner, calculating vacation pay for hourly employees can prove to be a challenge. Making sure that shifts are backfilled to ensure adequate cover for your business, is a major concern when working out vacation pay for your hourly employees. Additionally, you always need to keep in mind that any type of paid leave is a labor cost and therefore a liability to your business.

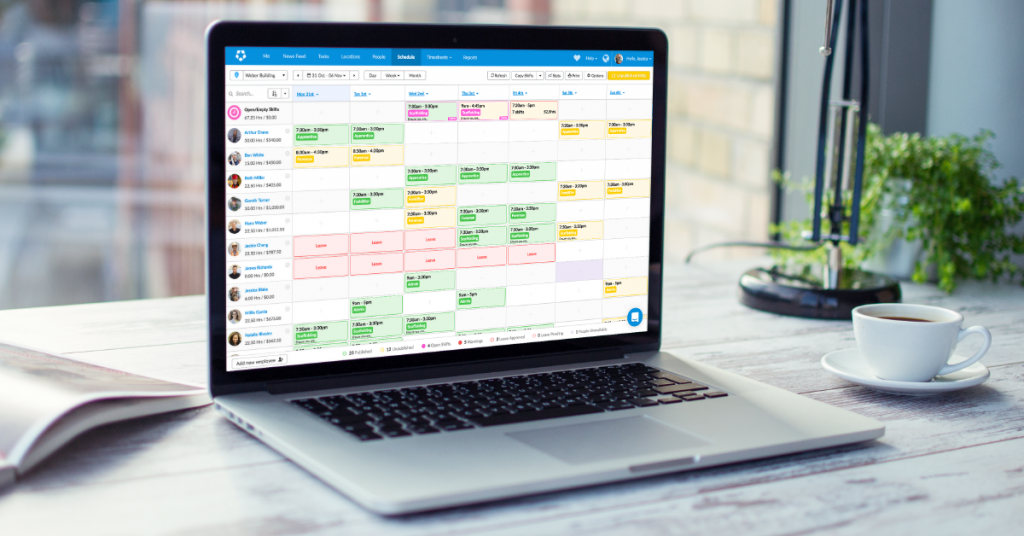

Just as not having a workforce management solution that’s able to cut down on the time your managers spend creating schedules is a liability for your business. If you currently don’t have a workforce management solution for your business, click on the link to begin your free trial of Deputy. The highest rated workforce management solution by G2 Crowd.

Vacation pay and the law

As an employer in the US, you are not legally obliged to give your employees paid time off for vacations. Therefore, if you offer vacation pay, the hourly rate will depend on the leave policy that you have implemented in your business. Providing clear details to your hourly employees about their vacation pay will allow them to plan the amount of time to take off, without compromising the amount of money they earn.

There are some states where vacation is considered a form of compensation, despite that there are no federal laws that regulate employee vacations. You should check with your state to find out whether you must let your employees accrue vacation or be paid for any unused vacation time.

Who is entitled to vacation pay?

The Fair Labor Standards Act (FLSA) does not require you to make payments to employees for the time that they have not worked, such as sick time, holidays or vacations. Data supplied by The Bureau of Labor Statistics show that 73% of workers who worked for private companies were given vacation days. Workers in sales and office jobs, transportation, production, material moving jobs were some of the highest percentage of workers who received vacation pay (80%).

The information provided by The Bureau of Labor Statistics also found that the amount of vacation time that employees were entitled to varied according to the length of time in employment.

The Bureau of Labor Statistics data showed the following:

- Employees who worked with a company for one year received an average of 11 days paid vacation.

- Workers who have been with a company for five years were entitled to an average of 15 days paid vacation.

- Employees who had between 10 and 20 years working with a company could receive 17 and 20 days (respectively) of paid vacation.

According to Expedia, the amount of paid vacation time offered in the US falls behind most other countries in the developed world. For example, Australia, New Zealand and most European countries offer employees at least 25 days holiday. Expedia also found a disparity between the number of paid vacation time workers in the US took off, even when they are entitled to it. On average, US workers will have three unused vacation days, while most employees in other countries will use all of their paid vacation entitlement.

Although you are not obligated to provide vacation pay to your hourly employees, making this option available can have positive effects on your business. Research shows that when employees take time off, your business benefits from less employee turnover and a boost in productivity.

Paid time off (PTO)

When contemplating whether to provide vacation pay for your hourly employees, you could group together personal days with vacation time and sick time. The total number of days will equate to the PTO from work. Public holidays are normally excluded from PTO. The downside of PTO for your employees is that, an employee who has to deal with frequent family emergencies or sickness could end up with very little (or no) vacation time.

Ultimately, vacation pay for hourly employees is based on an agreement between your business and your workers, subject to state regulations. This agreement can take the form of an employment contract, a company policy or a collective bargaining agreement.

If you decide to provide vacation pay to your hourly employees the strategies below will help you to calculate entitlements. Choosing a strategy to calculate vacation pay for your hourly employees will be especially helpful to your business during the summer and fall. This is because businesses typically receive an increase in vacation requests during these periods.

Make a decision about how much paid vacation your employees can earn

The benefits of decreased turnover and increased productivity and employee satisfaction can only be realized if you accurately work out how much paid vacation your business is willing to offer, based on affordability.

Answer the following questions when determining how much paid vacation time you will offer your employees:

- Will full-time employees be entitled to earn more vacation pay in comparison to your hourly employees?

- How much labor costs can your business realistically afford in relation to providing paid vacations?

- Do your employees need to complete a specific number of days, for example 90 days, before they are entitled to vacation pay?

Consider how your hourly employees will get their paid vacation time

After you have figured out how much vacation time your hourly employees can earn, you will then need to work out how you will allocate this time. You can choose to provide vacation time at the beginning of the year.

Alternatively, you can use the accrual method where your hourly employees will earn vacation time when they work. Vacation time can be accrued on a monthly basis for salaried employees or based on the number of hours worked for hourly employees. For instance, your hourly employees can get 7 hours of leave every month that they have worked. You can also choose to base your vacation pay on the number of years an employee has worked with you. You could allocate a week for every year of service, with a stipulation that employees will only be entitled to a specific number of weeks.

It is recommended that you use the accrual method if you employ hourly workers. This is because businesses that utilize hourly workers normally experience a high level of employee turnover. Therefore, they could end up at a financial disadvantage if paid vacation time is given at the beginning of the employment period and the employee decides to leave.

Work out the numbers

Now that you have decided on the number of vacation days your employees will receive and how you will allocate the time, you need to calculate how much paid time off has been earned. For example, if you have decided that you want your hourly worker to accrue 80 hours a year, you can work out the fraction of an hour they need to earn for every hour worked.

We will continue with the example above where your hourly worker is entitled to 80 hours per year, or two weeks. There are 52 weeks in a year, however, as your employee will not be working for two weeks out of the year, you will need to multiply 40 hours by 50 weeks, which equates to 2000 hours.

The figure of 2000 hours represents the number of hours your employee would work if they were full-time, with two weeks off. Please note, that this does not include paid holidays, although you could include these in the calculation.

Work out the vacation pay formula

Based on the example above, the vacation pay formula is as follows:

- Divide 80 by 2000 – this is the maximum number of hours to earn per year/hours worked per year) to get .04.

A full-time employee would earn the whole 80 hours in time off. However, your hourly employees who do not work full-time will not accrue 80 hours in time off. This formula will help you allocate the right number of vacation days to your hourly employees irrespective of the amount of hours they work.

Calculate and monitor vacation pay for hourly employees

It is important to calculate your hourly employees’ vacation pay accurately. You need to ensure that vacation balances are correct for all your employees. It is also crucial to be able to have an overview of which vacation days have been granted to prevent understaffing.

Below are some methods for calculating and tracking your hourly employees’ vacation pay:

Manual calculation and tracking with a spreadsheet

If you are comfortable with using Excel and working with formulas, you could attempt to manage your hourly employees’ vacation pay using a spreadsheet.

In order for this tracking method to be effective, you need to include the following:

- Your hourly employees’ maximum vacation hours per annum.

- The maximum number of hours your hourly employees can work per annum.

- The rate of your hourly employees’ vacation accrual.

- The amount of hours your employees work in each pay period.

- The number of vacation hours that your hourly employees earn in each pay period.

- The amount of vacation pay that your hourly employees earn in each pay period.

Although Excel spreadsheets may be convenient to set up, they can become confusing as your business grows or when more holiday requests are made.

Use scheduling software for seamless and automatic calculation.

Workforce management software, like Deputy provides a host of scheduling features including leave management. With Deputy, you can effortlessly manage your leave workflow where your hourly employees apply for leave and you can easily approve requests. Deputy also has the open shifts function that backfills shifts for your employees who have taken time off.

To ensure that leave management and tracking is a seamless process, Deputy allows you and your hourly employees to view the amount of leave available in hours or days, in one area. This removes the burden of looking through payslips or checking different systems to find out about leave entitlements.

It is easy to sync Deputy leave balances with the numerous payroll services that integrate with our solution. We partner with payroll services like Xero and QuickBooks to enable you to quickly and easily display your employees leave balances in Deputy. This means that you can approve leave requests in a matter of seconds after you have reviewed the scheduling needs and labor costs for your business.

Your company vacation policy

As seen above, you determine the amount of time your employees receive in vacation pay. Irrespective of the form your vacation policy takes, you need to ensure that you apply certain rules. Be aware that your vacation policy must be applied fairly. Therefore, there can be no discrimination on grounds of race, gender, religion, or other protected characteristics when allocating vacations or any other type of time off work.

You must also decide what will happen if your employees do not use their vacation time during the designated period. You could apply a ‘use it or lose it’ policy or vacation hours could be carried over to future periods. If you allow time to be carried over, you will need to specify the amount that can be carried over as well as the deadline for taking vacation days.

Calculating your hourly employees’ vacation pay does not have to be stressful or time-consuming.

Sign up for a free trial of Deputy to find out how we can help you with leave management and all other aspects of your business scheduling needs.