Scheduling software

for small and medium

businesses

Unlock an easier way to roster staff and get the business insights you need to grow.

TRUSTED BY 385,000+ WORKPLACES ACROSS THE GLOBE

“With Deputy, we can actually get our job done better so we can put more time and money where it’s really needed.”

Ronelle Reid, Head of Marketing and Customer Experience, RSPCA Queensland

Your go-to platform

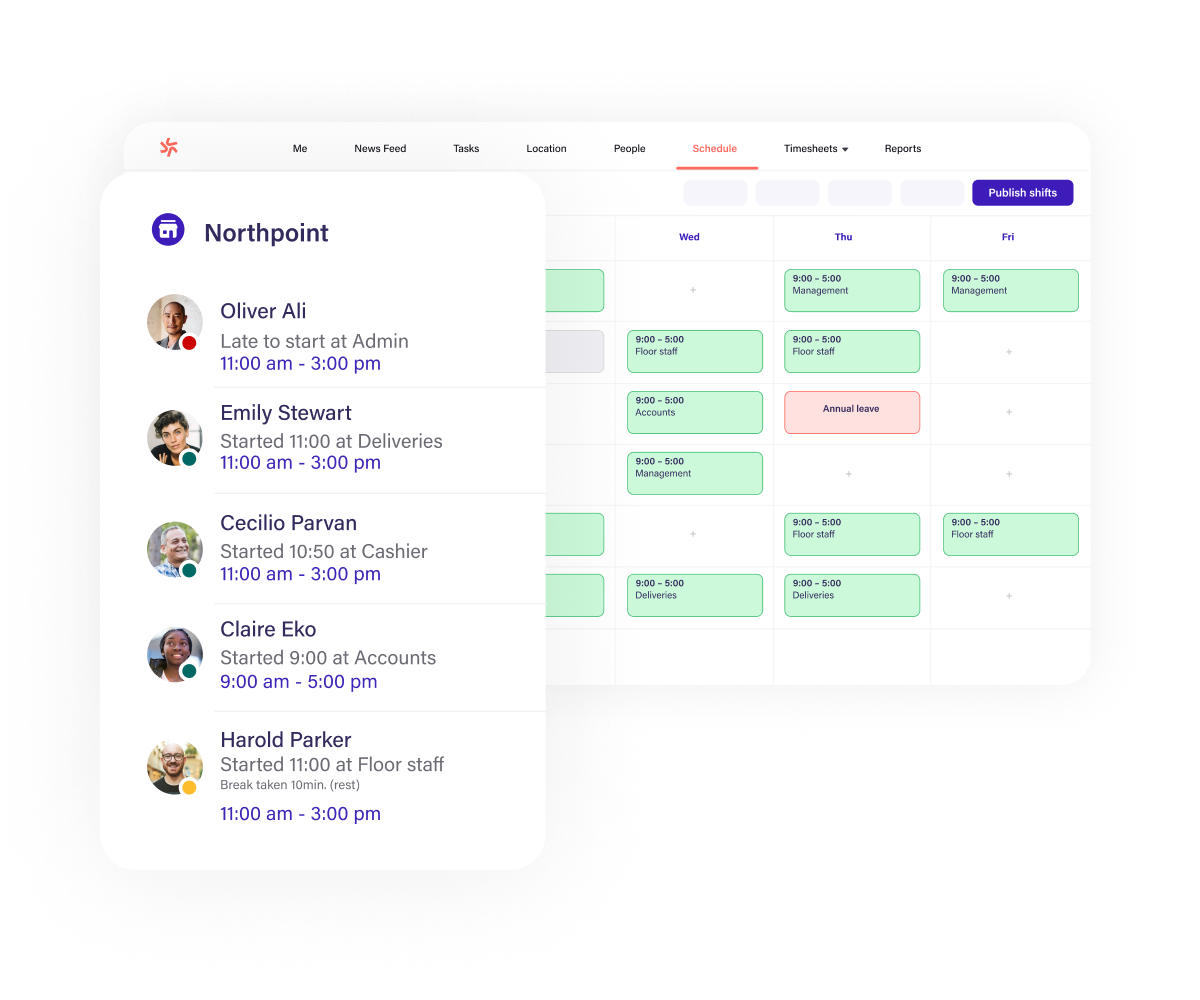

See everything in one place

Bring all your staff and key data together in one place that’s easy on the eyes. Keep track of staff availability, time off, hours worked, and wage costs without chaotic spreadsheets.

“With Deputy, we can actually get our job done better so we can put more time and money where it’s really needed.”

Ronelle Reid, Head of Marketing and Customer Experience, RSPCA Queensland

“Deputy tells us the wage cost for each store so we can see if we’re over-staffed and adjust accordingly.”

Declan Lee, Director & Co-Founder, Gelato Messina

Efficient rosters

Streamline rostering

Create and share work rosters in minutes. Keep your team under budget. And always have the right number of staff on hand when your customers need them most.

“Deputy tells us the wage cost for each store so we can see if we’re over-staffed and adjust accordingly.”

Declan Lee, Director & Co-Founder, Gelato Messina

“Having Deputy on my phone helps me understand where everyone is and what they are doing”

Drew Schofield, Business Owner, The Peel Inn Hotel

Smart mobile app

Manage changes on the go

Approve shift swaps with one tap on mobile. Instantly find last-minute replacements when staff call in sick. And adjust rosters to meet changes in customer demand.

“Having Deputy on my phone helps me understand where everyone is and what they are doing”

Drew Schofield, Business Owner, The Peel Inn Hotel

“We've got 100% accuracy of every employee’s timesheets. Now we know everyone is getting paid for the correct hours.”

Peter Martino, CEO, Azzurri Concrete

Team visibility

Simplify timesheets and award compliance

Get a clear picture of employee time and attendance — and automate key award wage calculations. Feel confident that everyone is paid for their exact hours.

“We've got 100% accuracy of every employee’s timesheets. Now we know everyone is getting paid for the correct hours.”

Peter Martino, CEO, Azzurri Concrete

Take Deputy for a spin today

Seamlessly connect with your other systems

Deputy integrates with leading payroll, POS, and HR systems and gives you a smooth experience from day one.

What makes Deputy stand out?

The short answer is, our software is the easiest way to run thriving teams — and it's simple to pick up. Follow the links below for the bigger picture.

Frequently asked questions

- What is rostering software?

Medium and small business rostering software is used to plan rosters so you always have the right number of staff when you need them. Rather than using paper, whiteboards or spreadsheets to plan shifts, the technology provides business owners and managers with a simple way of creating rosters in minutes.

You can then share these plans with employees via an app, email or even over text. Roster apps for small businesses come with plenty of other features too - letting you to connect to payroll systems, allowing staff to swap shifts with one another, approving leave requests, and more.

- Why is Deputy the best rostering app for small businesses?

Deputy is an Australian startup that was founded in 2008. It was built by small business owners just like you who wanted to plan employee rosters more effectively. We designed our rostering software for businesses so it would have all features you need to plan shifts, allocate tasks, monitor labour spend and reduce costs. That means you have more time to focus on the things you love.

Deputy is used by thousands of small businesses around the world to save money and time with fast, efficient and easy-to-use rostering tools that connect to your payroll systems. And Deputy does more than ‘just’ scheduling. We’ve built powerful features that help you boost employee engagement, smooth the onboarding process, attract the best staff, train people and stay compliant with regulations - and much more.