Wage Theft Prevention Act

Employees of any organization are held to high standards that include putting in extra effort into every single shift, helping to train and assist co-workers, dealing with rude customers, etc.

So it only makes sense that employers handle their role of assuring their employees receive their paychecks in full and on time.

Unfortunately, some employers have the negative tendency of taking the money right out of the pockets of their own employees in the form of wage theft. So much so, that it’s estimated that employers are keeping over 15 billion dollars each year that rightfully belongs to their employees.

To cut down on these employers that are unfairly taking advantage of their staff’s wages, many state and local governments have enacted legislation commonly referred to as wage theft prevention acts to cut down on wage theft and ensure that workers are receiving their due pay. The most well known of which is the New York Wage Theft Prevention Act of 2011.

What is Wage Theft?

Wage theft is a term used to describe a variety of issues that arise when workers don’t receive their legally or contractually promised wages.

The most common forms of wage theft are:

- Not paying for overtime.

- Not paying last paychecks after an employee leaves their job.

- Not paying employees for all of their hours worked.

- Not paying the full minimum wage.

Wage Theft facts

To give you a better idea of how much of an issue wage theft is for many American workers, take a look at these statistics below to get a better idea:

2.4 million workers (in the 10 most populous U.S. states) lose $8 billion annually to minimum wage violations, which is nearly a quarter of their earned wages.

In the retail industry alone, over 350,000 workers are impacted by minimum wage violations.

Wage theft also affects white collar workers in the form of “anti-poaching” arrangements that intimidates workers with threats of criminal prosecution if they were to look for another job.

68% of U.S. born workers have experienced overtime violations.

Los Angeles experiences some of the highest rates of wage theft for any city in America, with an estimated $26 million lost per week.

Fair Labor Standards Act

Whenever an employer refuses to pay an employee, the laws they’re breaking are in violation of the Fair Labor Standards Act. The act provides for a federal minimum wage as well as allowing states to set their own minimum wage (as long as it’s higher). It also requires employers to pay one and a half times the normal rate for all hours worked over 40 hours a week.

In addition to the Fair Labor Standards Act, the Davis-Bacon Act states that workers being paid by a contractor or subcontractor of a federal government are entitled to receive the prevailing wage for that work in whatever area in the U.S. that the work is done.

This is because government calculated prevailing wages are higher than minimum wage and unfortunately many federal contractors try to get around paying this extra fee.

Contractors that aren’t federal also try to avoid their fair share of federal taxes by misclassifying certain employees as independent contractors. This is because employers that misclassify workers as independent contractors don’t have to pay their fair share of federal taxes.

State-specific laws

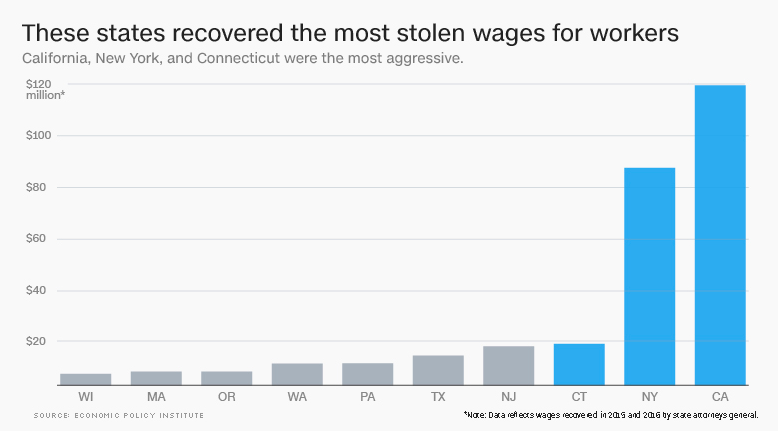

To get a better idea of the specific laws states have passed to combat wage theft, take a look at the guide below that gives a brief overview of wage laws for the four states with the highest rates of wage theft.

On April 9, 2011, the New York Wage Theft Prevention Act came into effect that required employers to give written notice of wage rates to all of their new hires.

The notice employers give must include:

Rate or rates of pay, including overtime rate of pay

How the employee is paid: by the hour, shift, day, week, commission, etc.

Regular payday

Official name of the employer and any other names used for business

Address and phone number of the employer’s main office or principal location

Allowances taken as part of the minimum wage (tips, meal and lodging deductions)

Also, the notice must be given both in English and in the employee’s primary language (as long as the labor department offers a translation). The translations the labor department offers are in the following languages: Spanish, Chinese, Haitian Creole, Korean, Polish, and Russian.

On January 1, 2018, a new wage theft prevention act took effect in California that expands the authority of the state labor commissioner’s enforcement. California law now disallows employers from firing workers or from taking any harmful actions against employees and job applicants who are exercising their rights under state employment laws.

If any employee were to experience any unlawful retaliation, they may be entitled to either job reinstatement or reimbursement for any lost wages and work benefits. It is also possible for the disgruntled employee to file a complaint with the California Division of Labor Standards Enforcement.

There are also new penalties in effect, an employer may have to pay the labor commissioner’s reasonable attorney fees if violations are found and may have to pay $100 per day (up to 20,000) if they willfully refuse to comply with a court order.

To go more in-depth on the recent ruling, take a look at S.B. 306.

Employers in Connecticut are required to pay employees overtime at a rate of 1.5 times their regular rate when they work more than 40 hours in a workweek, although some exceptions apply.

Connecticut labor laws require employers to provide their employees with a meal period of at least thirty consecutive minutes if they’ve worked for 7.5 or more hours consecutively.

Although it should be noted that the Labor Commissioner will exempt an employer from this requirement if one of the below conditions are present:

Complying with this requirement would endanger public safety

The duties of the position can only be performed by one employee

The employer employs fewer than 5 employees on that shift at that one location (applies only to employees on that particular shift)

The employer’s operation requires that employees be available to respond to urgent conditions and that the employees are compensated for the meal period.

The New Jersey State Wage and Hour Law established a minimum wage rate and overtime rate for all workers in New Jersey that are covered by the Act. The law requires the payment of time and one half per hour for actual hours worked in excess of 40 hours, with certain exemptions.

The New Jersey State Wage Payment Law stipulates the time, manner and mode of payment, and prohibits the withholding of wages for illegal deductions like breakage and shortages in cash registers.

Wage Theft and Hourly Workers

Wage theft is widespread and there are almost no workers that are completely immune. Hourly workers, in particular, are more susceptible to wage theft situations.

While most would be quick to assume that hourly worker wage theft is due to negligent employers, there is often a disconnect between employers and their systems in place to keep account of all of their employees’ hours worked for the week. Often used techniques like pen & paper or an Excel spreadsheet just don’t cut it and can lead to miscounted hours.

That’s why it’s a good idea for employers to have a software system in place that can handle their employee scheduling, keep track of time & attendance, as well as the ability to auto-schedule shifts to free up a manager’s time and an on-site time clock to guarantee an accurate display of each employees amount of hours worked. Take a look at Deputy’s features to get a better sense of how it can serve you and your employees.

What do workers do when their wages get stolen?

Many would be quick to assume that employees in a stolen wage situation can quickly and easily file a lawsuit and be on their way to a big payday.

Unfortunately, the reality is that many workers aren’t aware of their legal options whenever they find themselves in a wage theft situation, and even in the situations where they are aware of their legal options, they’ll usually choose to ignore the wage theft as to not risk losing their jobs.

That’s why the first option for many wage theft victims is to get a group of employees together to confront their boss or to go public with the information, which unfortunately also puts them in the situation of putting their employment in jeopardy.

That said, there are over 200 worker centers found throughout the United States that work to improve the lives of workers in all types of industries by fighting wage theft, low wage, and assisting non-unionized workers.

What should employers do?

As an employer, you should have clear policies in place that are explicitly written in your employee handbook regarding how you guarantee your employees that all hours worked will be fairly accounted and paid for. You should also clearly state the steps that should be taken if an employee suspects that any of their hours were miscalculated.

If a situation does arise where an employee feels like they were shortened, make sure to:

Do not make the employee feel uncomfortable for wanting to get clarification, understand that this is how they provide for themselves and their loved ones and are just trying to ensure that they aren’t being taken advantage of.

Have a manager sit down with the employee to calculate the total hours worked together so that they can see exactly how their paycheck was calculated.

If there was a miscalculation that took place, make sure that you take the time out to get to the bottom of how it occurred.

If it was because the employee inputted information incorrectly, explain what happened and how to ensure it doesn’t happen again.

If it was on you or one of the managers, admit fault, and apologize to the employee. Admitting fault is great for building trust with your employees and you’ll come to find that an apology benefits you as much as it does your team.

You should also work to implement steps within your management to ensure that the issue no longer continues. This includes making swift changes to your systems to better handle your time clock as well as your time & attendance techniques. If you’re curious to learn more about an all-inclusive software system that can assist you in diminishing worries of uncounted hours, schedule time with one of our Deputy reps below to learn more.

Closing thoughts

All employees, regardless of their industry, deserve the peace of mind of knowing that their paychecks will accurately display how much work they put in for their employer. Plenty of states have now enacted their own legislation, as shown in the New York Wage Theft Prevention Act, that works to empower workers and ensure that steps are in place to assure that all types of employees no longer have to worry about the negative effects of employers guilty of wage theft.