Downloadable Calculator for Debt to Equity Ratio Formula

If you have ambitions of growing your business, you’ll need investment capital for things like hiring employees, sourcing new products, and providing incentives such as health insurance. You have a number of different options in relation to raising capital for your business expansion. For example, you can choose to get a bank loan or offer shares in your business. These types of capital are known as debt or equity, respectively. The method you choose to raise capital for your company may have an impact on the financial health of your business.

When thinking about selling your business, potential buyers will evaluate your debt to equity ratio as an indication of whether your business is a good investment. Your company’s debt to equity ratio measures how much debt has been taken to finance operations, in comparison to the amount of capital that is available. Therefore your company’s debt to equity ratio is an indication of its financial leverage.

Leverage is how your business uses debt to buy its assets and finance its activities. Your company will be considered to be highly leveraged if it uses debt as the main way to finance its day-to-day operations. In these circumstances, your company will have a high debt to equity ratio.

Downloadable Calculator

Click on the button below to help simplify the process of calculating Debt-to-Equity Ratio by allowing you to plug in your values and come up with your calculation.

How to calculate debt to equity ratio

The debt to equity ratio formula is a simple calculation that lets you know how capital has been raised to operate or grow a business. This financial metric is important because it’s an indication of whether your company is stable and whether you can raise more money to expand in a viable way.

If you own a small business, this ratio will be used if you have applied for a business line of credit or a loan with a bank. This ratio will tell the lenders whether you’re able to make the repayments on the money you want to borrow.

The debt to equity ratio can also be used by investors to find out the amount of risk involved in investing in a company. Typically, a low debt to equity ratio means that there will be less risk in relation to the investment.

Debt to equity ratio formula

To find the debt to equity ratio of your company, you need to take the amount of money your company utilizes to finance its operations and divide this figure by the total available capital.

Here is the debt to equity ratio formula:

Debt to equity ratio = Total liabilities / Shareholders’ equity

The following are the two main elements of the debt to ratio formula:

Total liabilities – The total liabilities signifies all the debt your company has, which includes short-term and long-term debt and any other liabilities.

Shareholder’s equity – To work out the shareholder’s equity, you must subtract the total liabilities from total assets. Your company’s balance sheet will list your total liabilities from total assets.

Here is an example of a debt to equity ratio:

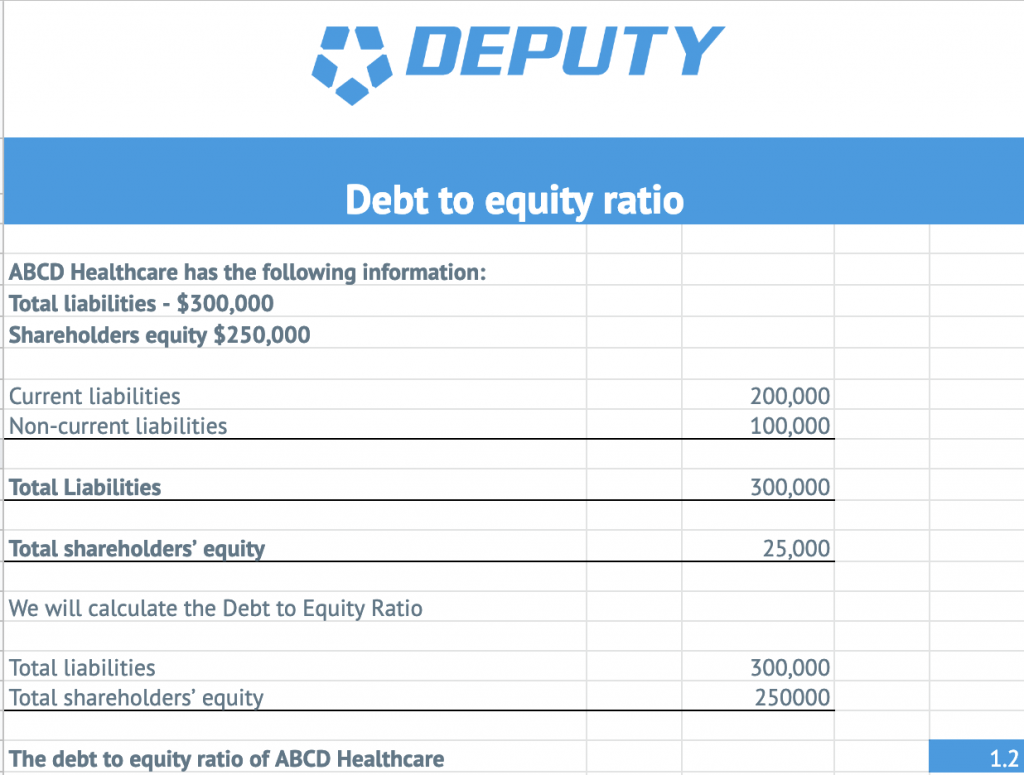

The owner of ABCD Healthcare wants to expand his practice and needs to work out his debt to equity ratio before applying for funding.

The healthcare practice has a total of $300,000 of liabilities and its shareholders’ equity is $250,000.

He has both current and non-current liabilities. So he first has to calculate the total sum of all his company’s liabilities.

The debt to ratio of ABCD Healthcare can be calculated as follows:

- Add current liabilities of $200,000 to non-current liabilities of $100,000.

This gives the total liabilities figure of $300,000.

- Divide the total liabilities ($300,000) by shareholders’ equity ($250,000)

This gives a total debt-equity ratio of 1.2.

- Divide the total liabilities ($300,000) by shareholders’ equity ($250,000)

Download the template below and add your figures to come up with the calculation of your debt to equity ratio.

The table below shows a representation of the example above:

ABCD Healthcare’s debt to equity ratio of 1.2 shows that the company is not highly leveraged, therefore it’s likely that the owner will be able to secure a loan on favorable terms.

Long-term debt to equity ratio

You can also work out how much of your company’s assets are financed using long-term financial commitments, such as mortgages. You can calculate your long-term debt to equity ratio using the following formula:

Long-term debt / Shareholders’ equity

You simply need to divide your long-term debt by the shareholder’s equity to find out your long-term debt to equity ratio.

Understanding the results of your debt to equity ratio

Before we look at how to interpret the results of the debt to equity ratio for your company, we will clearly define what we mean by debt and equity.

- What is debt?

Debt is the amount your company owes as a result of borrowing money for a private institution, bank or any other lender. Your company agrees to borrow money with the assurance that it’ll be repaid along with the relevant interest. The terms of the borrowing agreement are made at the time of the loan and will include details about the intervals when interest has to be paid.

Most businesses use debt to fund day-to-day operations or to scale their company. Typically, your company will need to show that you have hard assets to secure a loan. A hard asset is a receivable for your goods or services that the lender acknowledges as a way to pay back the loan. If your business is new, it may be more difficult to borrow money as you may not have had the opportunity to build up hard assets.

- Good debt

Some companies rely on debt even when they have the necessary assets to cover their expenses. This is because they can secure a more favorable rate of return on the money they have borrowed. This allows a company to create leverage on the amount that has been borrowed to allow investors to get a better return on their investment.

- Bad debt

If your company has a debt ratio of more than one, it does not automatically mean that you have too much debt. You need to consider your debt to equity ratio in comparison to other businesses in your industry. A high debt to equity ratio can portray your business as high risk. However, it can also give you higher leverage as some interest payments can be classified as tax write-offs.

What is equity?

Equity is the stock or the security that represent some type of ownership in your company. In other words, it’s your ownership of certain assets, like vehicles or property when you have finished paying the debt on the asset.

If your business uses equity financing, this means that shares are sold to investors in exchange for capital.

What is a positive debt to equity ratio?

The example above shows that ABCD Healthcare has a good debt to equity ratio. Generally, a positive debt to equity ratio is about 1 or 1.5. But, the best debt to equity ratio depends on different factors, for instance the type of industry your business operates in. Manufacturing industries are commonly known to have high debt to equity ratios (higher than 2).

A high debt to equity ratio is a strong signal that a company uses debt to facilitate its growth. If your company needs to invest large sums into operations and assets, it’s likely that it’ll have a high debt to equity ratio.

Where your company has a debt to equity ratio that is near zero, this means that you’ve been able to run your company and facilitate growth without borrowing money. Although a very low debt to equity ratio may appear to be a positive signal, investors may be wary of investing in this type of business. This is because they may believe that the company is not maximizing opportunities to increase profit as it refuses to use financing to grow.

The debt to equity ratio for your company should not be taken in isolation. Instead, it should be compared to historical periods to provide a better picture of what’s truly happening. For example, if your debt to equity ratio has risen dramatically in the last year, it could be because you have decided to grow your company in an aggressive way and a high level of debt is required to fund this growth.

The drawbacks of debt to equity ratio

The debt to equity ratio for your company can provide a good indication of its profitability. However, the following are some disadvantages to relying solely on this method:

- The definition of high debt to equity

There is no one-size-fits-all definition of a high debt to equity ratio because this figure varies according to different industries. In order to determine whether your debt to equity ratio is acceptable, you need to find out the normal range for businesses in your industry.

- Risk exposure

The likelihood of defaulting on your loans increases with an increase in your debt to equity ratio. Most small businesses need a reasonable amount of debt to expand. However too much debt can place an unnecessary burden due to the high-interest rates that accompany them. If your business does not grow as anticipated, a high debt to equity ratio can mean defaulting on loans, which could result in bankruptcy.

- Problems securing more finance

If you want to borrow more money from a bank, you’ll need to show that you have a low debt to equity ratio. A high debt to equity ratio may result in your application being denied or securing the loan with unfavorable terms to your business.

- Maintaining debt to equity ratio

There are some lenders who include the maintenance of a certain level of debt to equity ratio as a condition of a loan. For example, if you have secured a loan with a stipulation that your debt to equity ratio will remain at 1.5 for the duration of the loan and you exceed this, you may be required to repay the loan in full. This is because the increase in your company’s debt to equity ratio presents a higher risk that the lender is not willing to accept.

Benefits of debt to equity ratio

- Expansion and growth

A high debt to equity ratio could be an indication that you’re ambitious and are determined to grow your business. If you have assessed the risks and performed your due diligence in relation to how you can repay the debt and still remain profitable, a high debt to equity ratio can be extremely beneficial to your business.

You should conduct research into the acceptable debt to equity ratio levels for companies similar to yours because this figure varies according to different industries. Your research should be as detailed as possible in order to arrive at the right figure. For instance, if you’re planning to expand your food truck business, you need to compare the debt to equity ratio of other food trucks as opposed to different types of restaurants.

The normal level of debt to equity ratio varies according to your industry. However, one obstacle that all businesses who hire hourly staff have in common is the need to schedule staff efficiently, while saving on labor costs.

Deputy removes the uncertainty from the scheduling process and provides you with features such as auto-scheduling and a communication hub.

Click the button below for a free trial to see for yourself why Deputy is the highest-rated workforce management solution by G2 Crowd.