Scheduling software

for small and medium

businesses

Unlock an easier way to schedule staff and get the business insights you need to grow.

TRUSTED BY 385,000+ WORKPLACES ACROSS THE GLOBE

“Deputy has allowed us to be more strategic. We can easily do an entire month’s schedule in about 20 minutes.”

Andrew Mulholland, Assistant Manager, West Salem Ace Hardware

Your go-to platform

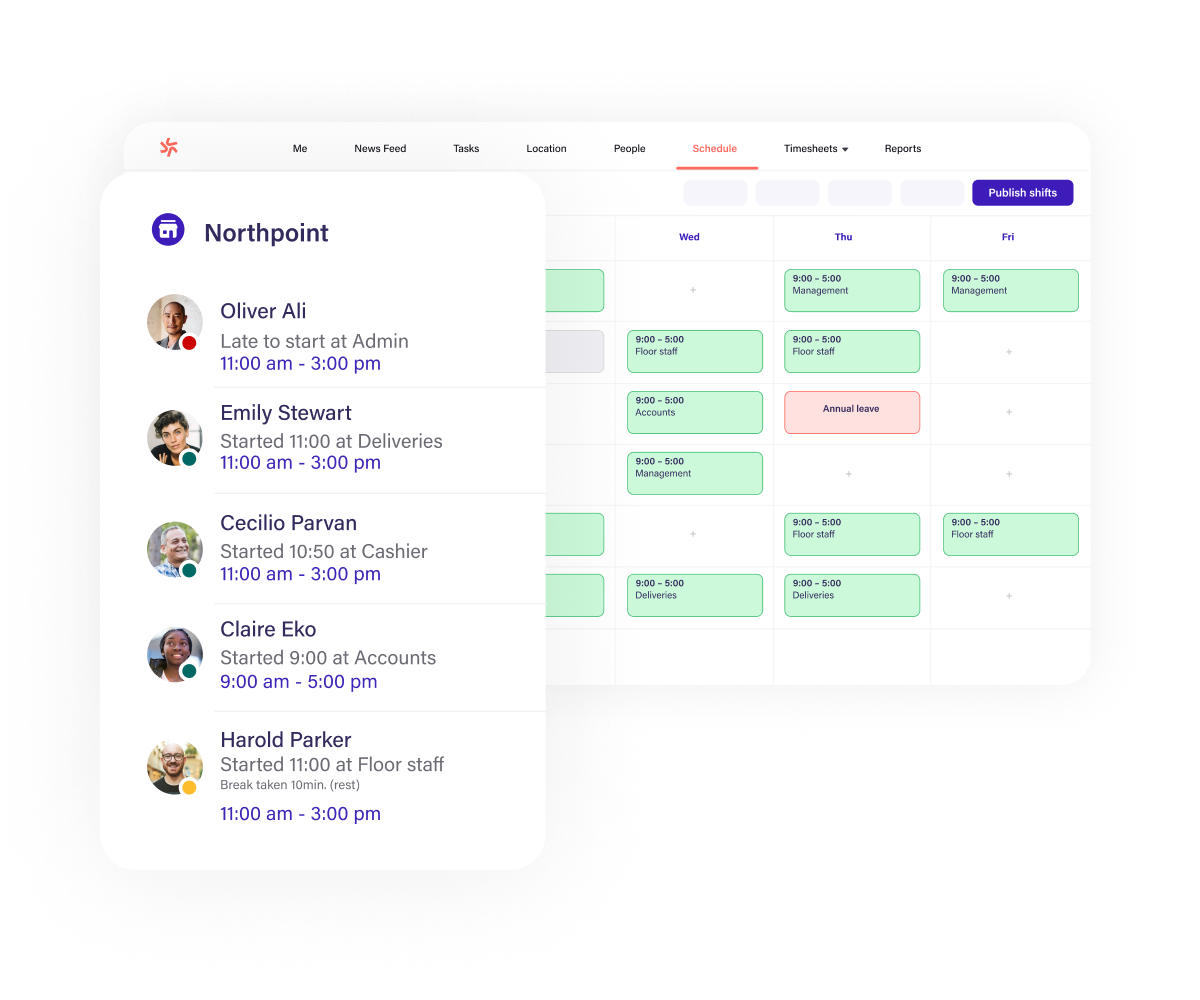

See everything in one place

Bring all your staff and key data together in one place that’s easy on the eyes. Keep track of staff availability, time off, hours worked, and wage costs without chaotic spreadsheets.

“Deputy has allowed us to be more strategic. We can easily do an entire month’s schedule in about 20 minutes.”

Andrew Mulholland, Assistant Manager, West Salem Ace Hardware

"Cost savings of $11,000 – $13,000 each year by eliminating the 'overlap time' between shifts alone"

Kathy Lois Jones, Owner, Elder Village Euless

Scheduling for small business

Streamline team scheduling

Create and share work schedules in minutes. Always have the right number of staff on hand to match demand. And stay under budget with live data on wage costs vs sales.

"Cost savings of $11,000 – $13,000 each year by eliminating the 'overlap time' between shifts alone"

Kathy Lois Jones, Owner, Elder Village Euless

"Deputy saved at least half-a-day or a day’s work calling around temporary workers."

Su San Chan, Head of Human Resources, St Joseph's Hospice

Smart mobile app

Manage changes on the go

Approve shift swaps with one tap on mobile. Instantly find last-minute replacements when staff call out sick. And make sure staff have the latest schedule on their phones.

"Deputy saved at least half-a-day or a day’s work calling around temporary workers."

Su San Chan, Head of Human Resources, St Joseph's Hospice

"My payroll processing time has been cut to just minutes, rather than an entire weekend, and the accuracy has gone to 100%."

Michael Finch, Business Owner, Harper Logistics

Time and Attendance

Simplify timesheets and labor compliance

Get a clear picture of employee time, attendance, and breaks. Automate complex wage calculations, including overtime. And feel confident that everyone is paid for their exact hours.

"My payroll processing time has been cut to just minutes, rather than an entire weekend, and the accuracy has gone to 100%."

Michael Finch, Business Owner, Harper Logistics

Small business? See how you can grow with our scheduling software

Seamlessly connect with your other systems

Our scheduling software links with the payroll, POS, and HR apps that small businesses depend on and provides a smooth experience from day one.

What makes Deputy stand out?

The short answer is, our software is the easiest way for small businesses to schedule staff perfectly. Follow the links below for the bigger picture.

Frequently asked questions

- What is scheduling software?

Scheduling software is a technology used by small and medium-sized businesses to plan staffing schedules. Instead of using paper, whiteboards or spreadsheets, the specialized software helps managers and business owners create shift patterns in minutes by using an intuitive interface. They can then share schedules with employees via an app, email or even text.

Small and medium business scheduling software comes with many other features that streamline the rostering process. It also allows employees to perform tasks such as swapping shifts with coworkers or submitting vacation requests.

- Why is Deputy the best scheduling app for small businesses?

Deputy was designed by small business owners just like you who wanted to plan employee schedules more effectively. We designed our employee scheduling software for small businesses to include all the features you need to plan shifts, allocate tasks, monitor labor spend and reduce costs - so you can spend time doing the things that really matter.

Since 2008, we’ve helped thousands of small businesses across the US to save time and money with fast, efficient and productive scheduling tools that connect to payroll systems. And it goes beyond ‘just’ scheduling. Deputy comes with powerful features that help you boost employee engagement, smooth the onboarding process, attract the best staff, train people and stay compliant with regulations - and much more.