Run efficient teams without the hours of admin

One place for managing your people, celebrated for ease of use.

EFFICIENT SCHEDULING

Keep your locations perfectly staffed

Organise your team in minutes and reduce unnecessary costs.

Demand forecasting

Plan shifts to meet changes in demand. Predict your staffing requirements based on sales trends, delivery orders, appointments, and other demand signals.

"We were able to save on labor costs from not having to spend money on drivers that weren’t needed for certain shifts."

Spencer Richardson, Business Owner, DropCar

Employee scheduling

Schedule teams with simple drag and drop tools. Avoid errors with a clear picture of staff availability, training, and cost. And send rotas straight to your team via web or mobile.

"Deputy gives us great reporting and an easy way for us to manage and optimise wage costs so that we can operate at maximum efficiency."

Gagan Arora, Director, New Age Security

Shift replacements & swapping

If someone can’t make their shift, find a qualified replacement with one tap in Deputy. And give staff the flexibility to swap shifts directly with suitable team members - without back and forth.

"It’s taken a lot of pressure off that time we used to spend on the phone trying to move people around and change shifts.

Carmel Goldsmith, Business Owner, IGA

Overtime management

Reduce unnecessary overtime and employee fatigue. Set a cap on how many hours team members can work across a day/week and receive an alert if they're at risk of going over.

"We can keep an eye on staff fatigue, tenure, holidays and time off, which helps us run our business better and look after our staff."

Alexandra Conroy, Director and co-founder , Reliant healthcare

Leave & availability

Manage your team’s leave in one clear system. Keep track of accurate leave balances, requests, and employee availability in Deputy.

"Now, TEKintellect’s instructors can simply report their own availability through Deputy straight from their mobile device."

Tsvi Katsir, Founder, TEKintellect

Auto scheduling

Build ideal rotas with one click. Use AI to create schedules that meet your requirements for budget, breaks, training, and spread of hours.

"Deputy’s auto-scheduling feature made schedules in just minutes, all while checking each drivers’ stress profile & availability so no one was assigned a shift they weren’t able to make."

Michael Finch, Business Owner, Harper Logistics

"We were able to save on labor costs from not having to spend money on drivers that weren’t needed for certain shifts."

Spencer Richardson, Business Owner, DropCar

"Deputy gives us great reporting and an easy way for us to manage and optimise wage costs so that we can operate at maximum efficiency."

Gagan Arora, Director, New Age Security

"It’s taken a lot of pressure off that time we used to spend on the phone trying to move people around and change shifts.

Carmel Goldsmith, Business Owner, IGA

"We can keep an eye on staff fatigue, tenure, holidays and time off, which helps us run our business better and look after our staff."

Alexandra Conroy, Director and co-founder , Reliant healthcare

"Now, TEKintellect’s instructors can simply report their own availability through Deputy straight from their mobile device."

Tsvi Katsir, Founder, TEKintellect

"Deputy’s auto-scheduling feature made schedules in just minutes, all while checking each drivers’ stress profile & availability so no one was assigned a shift they weren’t able to make."

Michael Finch, Business Owner, Harper Logistics

Staff attendance & everyday management

Manage teams remotely and handle the unexpected

Take care of last-minute rota changes with one click and view employee attendance in real time.

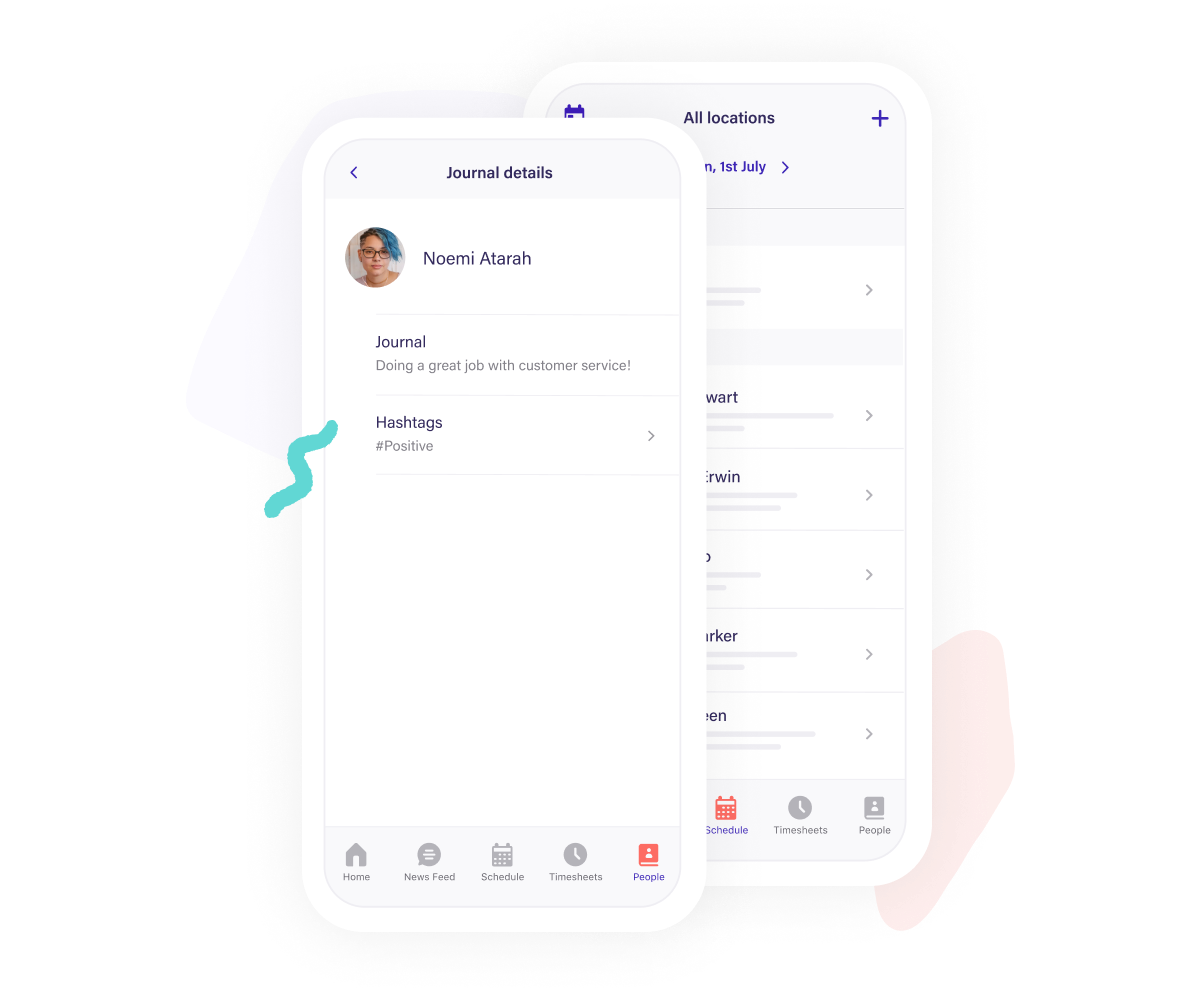

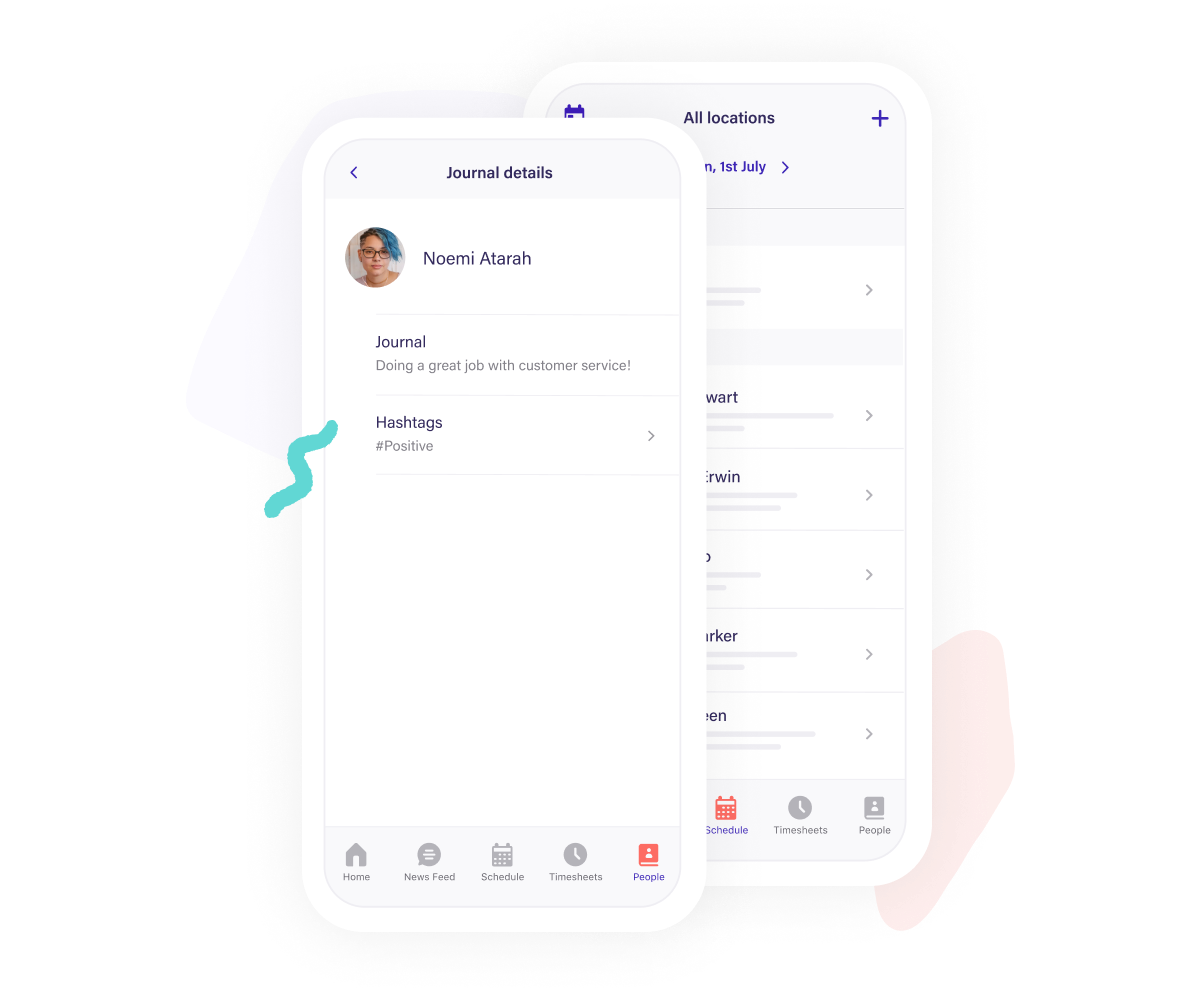

Intuitive mobile app

Make quick changes to your team’s rota, approve timesheets and leave requests, and make sure staff have seen important messages. All in one app.

"Now, much of the day-to-day running of the business — from scheduling to holiday management to approving timesheets— is done directly from the Deputy app."

Sarah Aoki, Business Owner, Perfect Cleaning Solutions

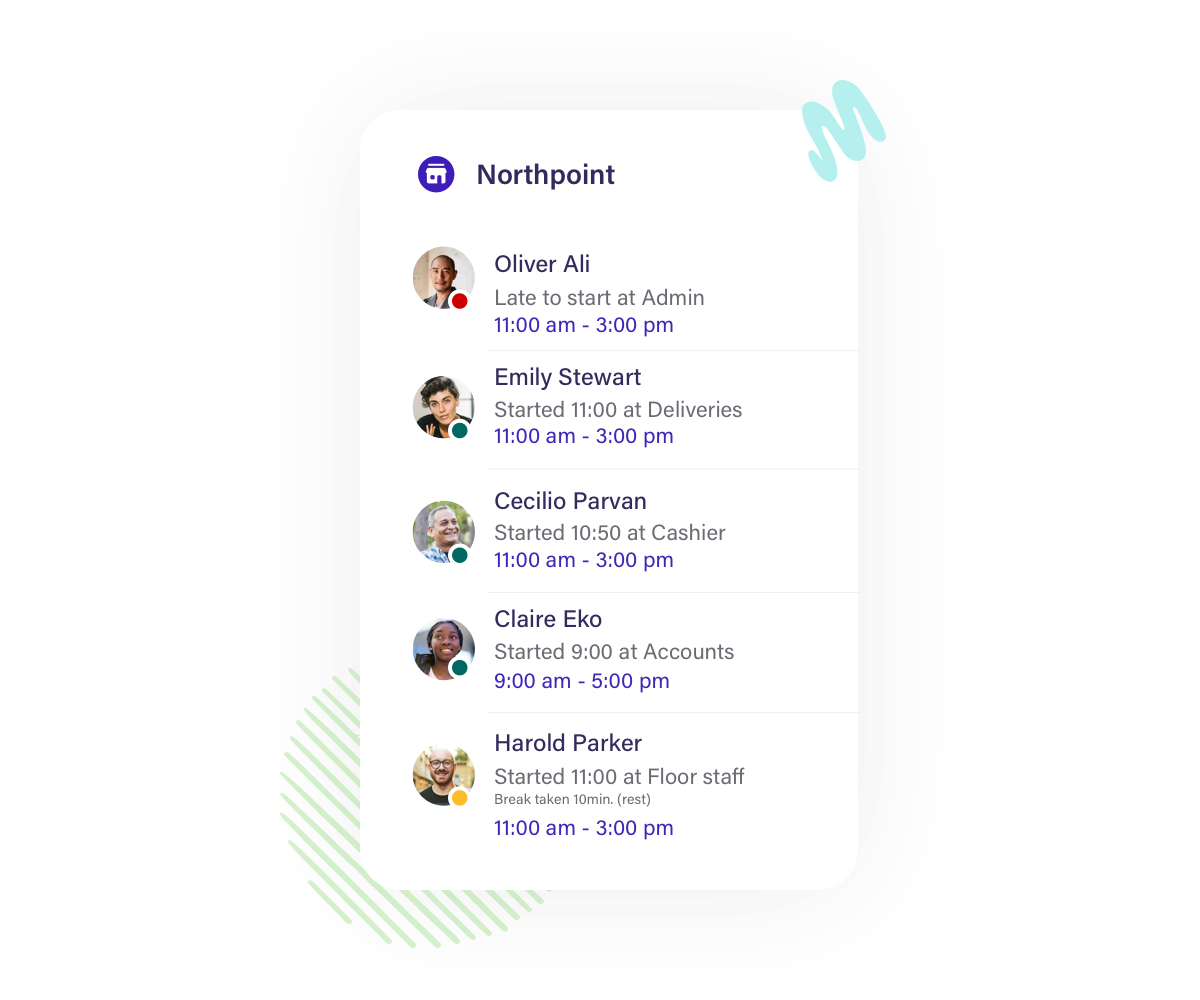

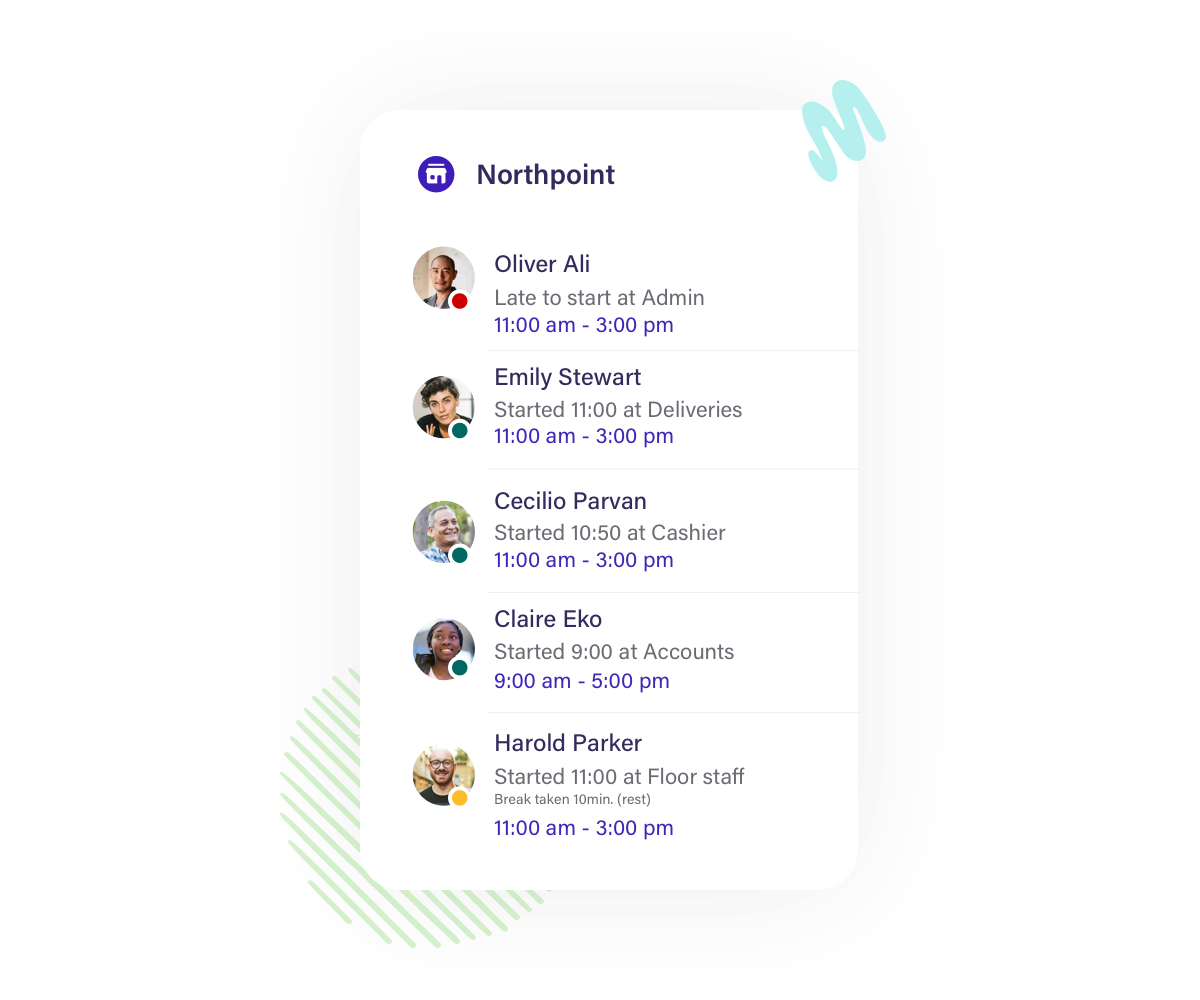

Attendance tracking

See who’s on shift, who’s running late, and who’s on break in real-time. When staff clock in and out of work via our time clock app, supervisors will get a live update.

"I know whether people are there or not just by opening up the Deputy app. It shows me the exact location they clocked in and out at."

Sarah Aoki, Business Owner, Perfect Cleaning Solutions

Last-minute shift replacements

Never be left shorthanded. If someone calls in sick, offer the shift to all available, qualified staff with one tap, send out mobile alerts, and receive an update when it’s filled.

"It’s taken a lot of pressure off that time we used to spend on the phone trying to move people around and change shifts.

Carmel Goldsmith, Business Owner, IGA

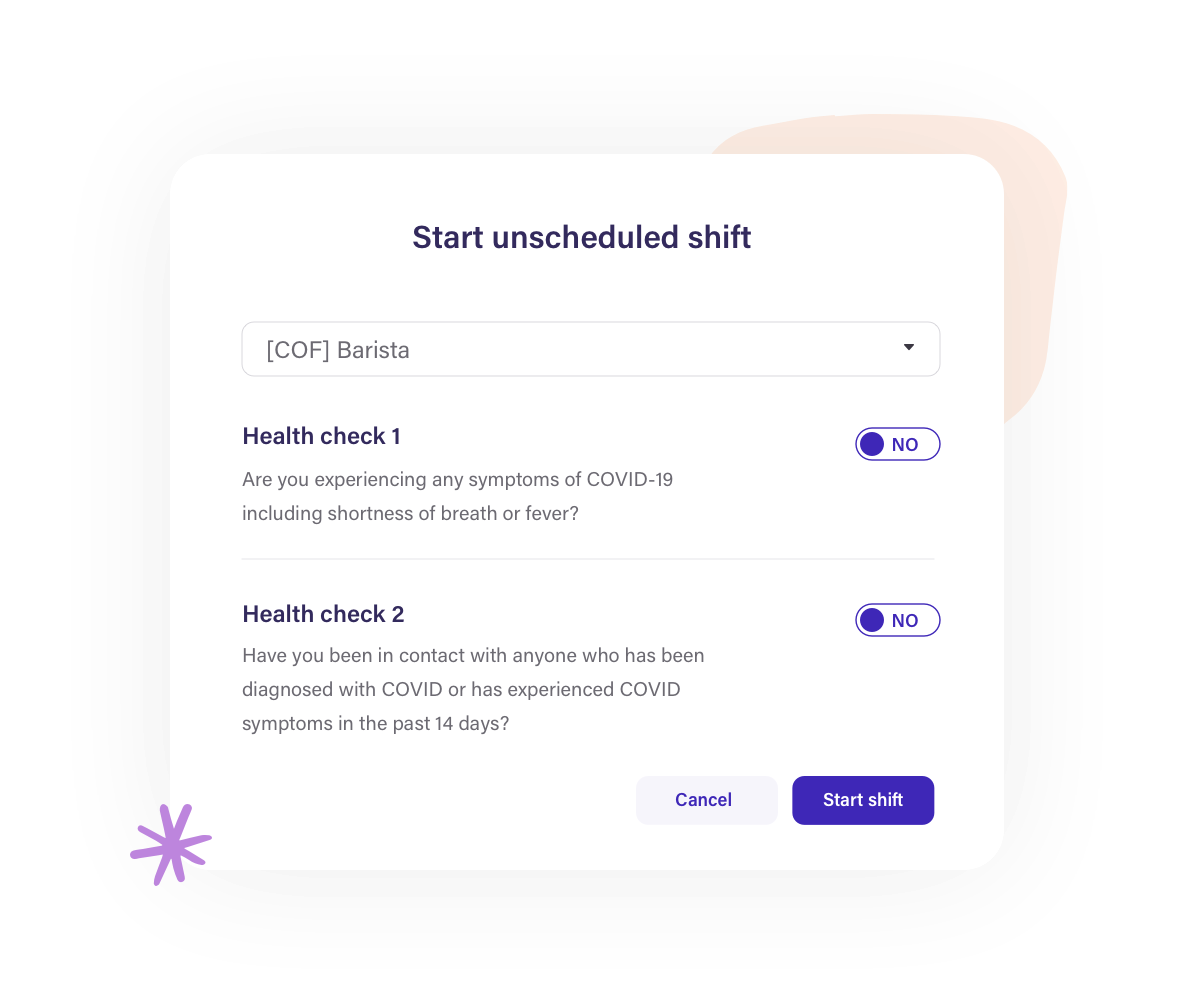

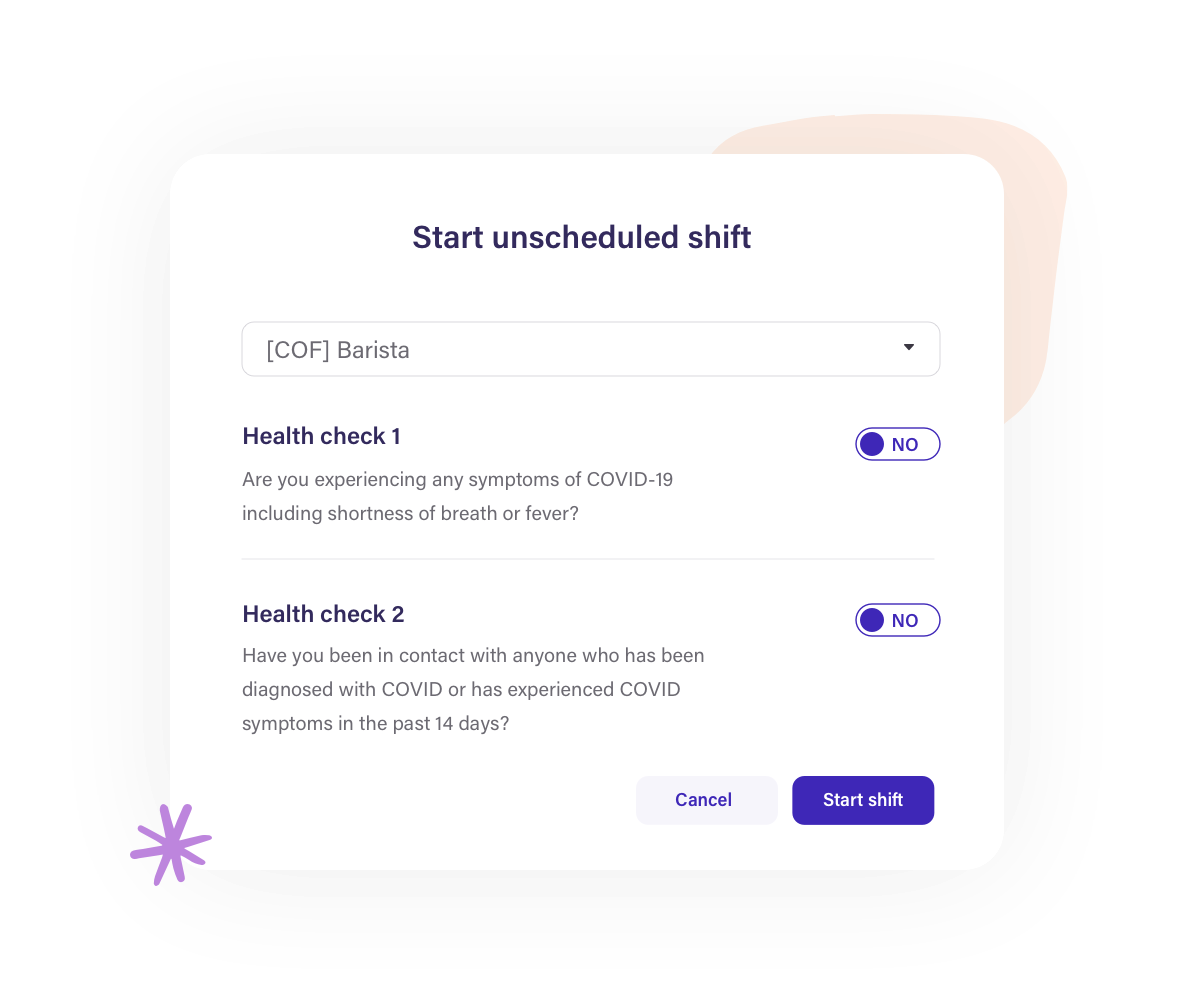

Health & safety

Help protect your staff and customers. Automatically screen employees for worrying symptoms to prevent the spread of illness. And if an employee comes down with a virus, instantly trace all the colleagues they’ve had contact with.

Communication

Make sure staff don’t miss important information. Share messages and documents on Deputy News feed and get notified when they’re read.

"The staff can communicate with each other and send out messages, which means I don’t have to send out a staff memo around the office about a particular issue."

Kate Gillenwater, Corporate Manager, Optometric Care associates

Tasking

Get jobs done. Assign one-time or recurring tasks to your teams, set due dates, and see when tasks are completed.

"Our people can also use the platform to set and respond to tasks and pass on important information back to the head office."

Gagan Arora, Director, New Age Security

"Now, much of the day-to-day running of the business — from scheduling to holiday management to approving timesheets— is done directly from the Deputy app."

Sarah Aoki, Business Owner, Perfect Cleaning Solutions

"I know whether people are there or not just by opening up the Deputy app. It shows me the exact location they clocked in and out at."

Sarah Aoki, Business Owner, Perfect Cleaning Solutions

"It’s taken a lot of pressure off that time we used to spend on the phone trying to move people around and change shifts.

Carmel Goldsmith, Business Owner, IGA

"The staff can communicate with each other and send out messages, which means I don’t have to send out a staff memo around the office about a particular issue."

Kate Gillenwater, Corporate Manager, Optometric Care associates

"Our people can also use the platform to set and respond to tasks and pass on important information back to the head office."

Gagan Arora, Director, New Age Security

Timesheets & workforce insights

Feel confident that staff are paid for their exact time

Capture accurate timesheets for seamless payroll and track essential workforce data.

Time clock app

Avoid timesheet headaches. Record accurate employee hours digitally via our time clock app on tablet, mobile, or desktop.

"Deputy has helped to reduce our employees showing up late by 80%."

Craig Stone, Owner, Harvest Health Foods

Payroll integrations

Reduce your admin workload. Connect Deputy with your payroll software to sync pay rates and export timesheets with one tap.

"My payroll processing time has been cut to just minutes, rather than an entire weekend, and the accuracy has gone to 100%."

Michael Finch, Business Owner, Harper Logistics

Break compliance

Help staff get the downtime they need. Schedule meal or rest breaks, prompt employees to take them, and flag breaks that are missed.

"Deputy automatically enforces compliance with guaranteed minimum breaks between consecutive schedules."

Jeremy Konko, Business Owner, The Platform Group Gallery

Record keeping & reporting

Achieve a clear view of scheduled hours, actual hours worked, wage costs, labour percentages, and profits.

"Deputy gives us great reporting and an easy way for us to manage and optimise wage costs so that we can operate at maximum efficiency."

Gagan Arora, Director, New Age Security

Qualifications record

Create a clear record of employee training and qualifications so you always schedule the right people for the job. Keep track of qualification renewal dates to avoid legal risks.

Pay rate builder

Pay Rate Builder offers unparalleled flexibility and control over how you pay your team, making compliance management easier than ever. By enabling you to create and configure custom pay rates, Deputy simplifies pay rate management, ensuring greater cost accuracy across all your employee agreements.

"Deputy has helped to reduce our employees showing up late by 80%."

Craig Stone, Owner, Harvest Health Foods

"My payroll processing time has been cut to just minutes, rather than an entire weekend, and the accuracy has gone to 100%."

Michael Finch, Business Owner, Harper Logistics

"Deputy automatically enforces compliance with guaranteed minimum breaks between consecutive schedules."

Jeremy Konko, Business Owner, The Platform Group Gallery

"Deputy gives us great reporting and an easy way for us to manage and optimise wage costs so that we can operate at maximum efficiency."

Gagan Arora, Director, New Age Security

EMPLOYEE ONBOARDING & IMPROVED RETENTION

Get started quickly and make life easier for your staff

Give staff an app that's simple to use and helps them keep track of their rotas.

New hire onboarding

Onboard new staff without messy paperwork. Capture all the essential contact, tax, and other essential details straight into Deputy.

"Deputy has definitely made it a lot easier to bring on new staff and grow our staff"

Amanda Swanson, HR Scheduler, Ace Hardware

Intuitive mobile app

Empower employees. The Deputy app is easy to use and helps staff manage their shifts, availability, leave, and communication in one place.

"Now, much of the day-to-day running of the business — from scheduling to holiday management to approving timesheets— is done directly from the Deputy app."

Sarah Aoki, Business Owner, Perfect Cleaning Solutions

Employee engagement

Supercharge your team’s voice with Shift Pulse™ and be in the know of how your team is feeling. Staff can provide insightful feedback at the end of each shift so you can address any issues — and keep your teams happy and engaged.

“Shift Pulse™ is a really valuable feedback loop for my staff’s workload and to ensure my team feels supported.”

Brandon Jacobs, Operations Manager, Quarry Park Adventures

Direct shift swapping

Give staff the flexibility they want — without having to manage every swap yourself. Employees can swap shifts directly with suitable team members via the Deputy app.

"Everything my employees need to do, whether it’s swapping shifts, putting in leave requests, or leaving a message, Deputy allows them to do it."

Bobby Heuser, Business Owner, Ace Hardware

Leave management

Make leave management easier for everyone involved. Employees can keep track of their own balances and request leave directly through the app — without any back and forth.

"Now, TEKintellect’s instructors can simply report their own availability through Deputy straight from their mobile device."

Tsvi Katsir, Founder, TEKintellect

Tasking & communication

Help your team stay organised, no matter the situation. Staff can keep track of critical messages, workplace procedures, and tasks in one clear system.

"Now it’s easy to send out alerts and share important news and announcements with everyone, wherever they are."

Sean O’Connor, Business Owner, Kingdom Projects

Performance management

Improve employee performance and engagement. Keep a clear record of performance ratings and feedback, celebrate high-achievers to boost morale, and identify staff that need more guidance or training.

POS, payroll, and HR integrations

Seamlessly connect Deputy with your other systems and save hours on admin. Sync employee details, pay rates, timesheets, and sales data.

"My payroll processing time has been cut to just minutes, rather than an entire weekend, and the accuracy has gone to 100%."

Michael Finch, Business Owner, Harper Logistics

"Deputy has definitely made it a lot easier to bring on new staff and grow our staff"

Amanda Swanson, HR Scheduler, Ace Hardware

"Now, much of the day-to-day running of the business — from scheduling to holiday management to approving timesheets— is done directly from the Deputy app."

Sarah Aoki, Business Owner, Perfect Cleaning Solutions

“Shift Pulse™ is a really valuable feedback loop for my staff’s workload and to ensure my team feels supported.”

Brandon Jacobs, Operations Manager, Quarry Park Adventures

"Everything my employees need to do, whether it’s swapping shifts, putting in leave requests, or leaving a message, Deputy allows them to do it."

Bobby Heuser, Business Owner, Ace Hardware

"Now, TEKintellect’s instructors can simply report their own availability through Deputy straight from their mobile device."

Tsvi Katsir, Founder, TEKintellect

"Now it’s easy to send out alerts and share important news and announcements with everyone, wherever they are."

Sean O’Connor, Business Owner, Kingdom Projects

"My payroll processing time has been cut to just minutes, rather than an entire weekend, and the accuracy has gone to 100%."

Michael Finch, Business Owner, Harper Logistics

What's new in Deputy

At Deputy, we're always looking for ways to Simplify Shift Work™ by improving our platform and adding valuable new features for our customers.See what's newSee what's newTry the ultimate scheduling app today. Start your free trial now!

The payoff of using Deputy

Reduce costs, save time, and create a better work-life balance. See how much your business will save with Deputy.

Why choose Deputy?

The power, flexibility, and mobility of our software has earned us more than 385,000 happy customers — who are our greatest advocates. With Deputy, you’re not just saving time and money. You’re finding a better way to do business.

The UK's leading scheduling software