The leading employee scheduling software to help you schedule your team in minutes

Get set up quickly for efficient online scheduling that will save you hours.

TRUSTED BY 385,000+ WORKPLACES ACROSS THE GLOBE

America's leading employee scheduling software

Employee scheduling software with smarts

LABOR COSTING

Control costs with real-time data on wages vs sales

Make sure you’re running on budget. Deputy gives you a clear view of how your wage costs compare to sales so you can improve your labor cost percentage.

AUTO-SCHEDULING

Create AI optimized schedules with a single click

Craft the perfect schedule for your business using Deputy's AI powered Auto-Scheduling. Reduce unnecessary wage costs with accurate labor demand forecasts.

DEPUTY ANALYTICS

Turn workforce data into business wins

With Deputy's built-in analytics, you don't need to be a data scientist to make smarter staffing decisions.

From shift costs to labor efficiency trends, our analytics tools surface actionable insights that help you reduce overspend, improve compliance, and forecast with confidence – no spreadsheets required.

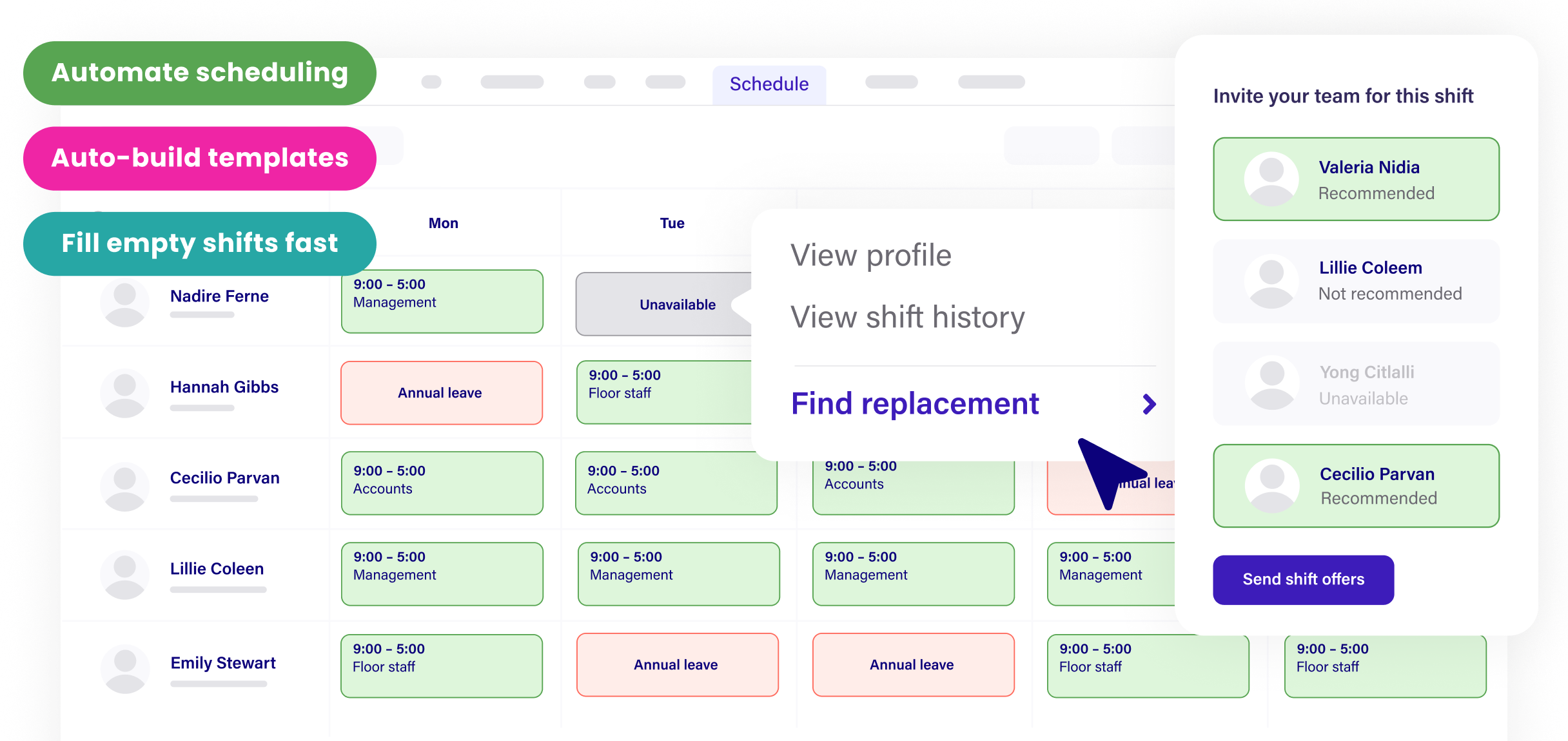

OPEN SHIFTS

Fill empty shifts quickly

Share available shifts with your team instantly via the Deputy app. Fill them on a first-come, first-served basis. Or pick the most suitable person from a list of interested staff.

WORKING REMOTELY

Manage your schedule from any location

Simply create, copy, and publish schedules; manage shift swaps; and find replacements from any device with employee scheduling apps for iPhone, iPad, and Android.

BREAK PLANNING

Simplify meal and rest break compliance

Schedule multiple breaks and break types in a single shift. Our scheduling app frees your business from the worries of break compliance and coverage.

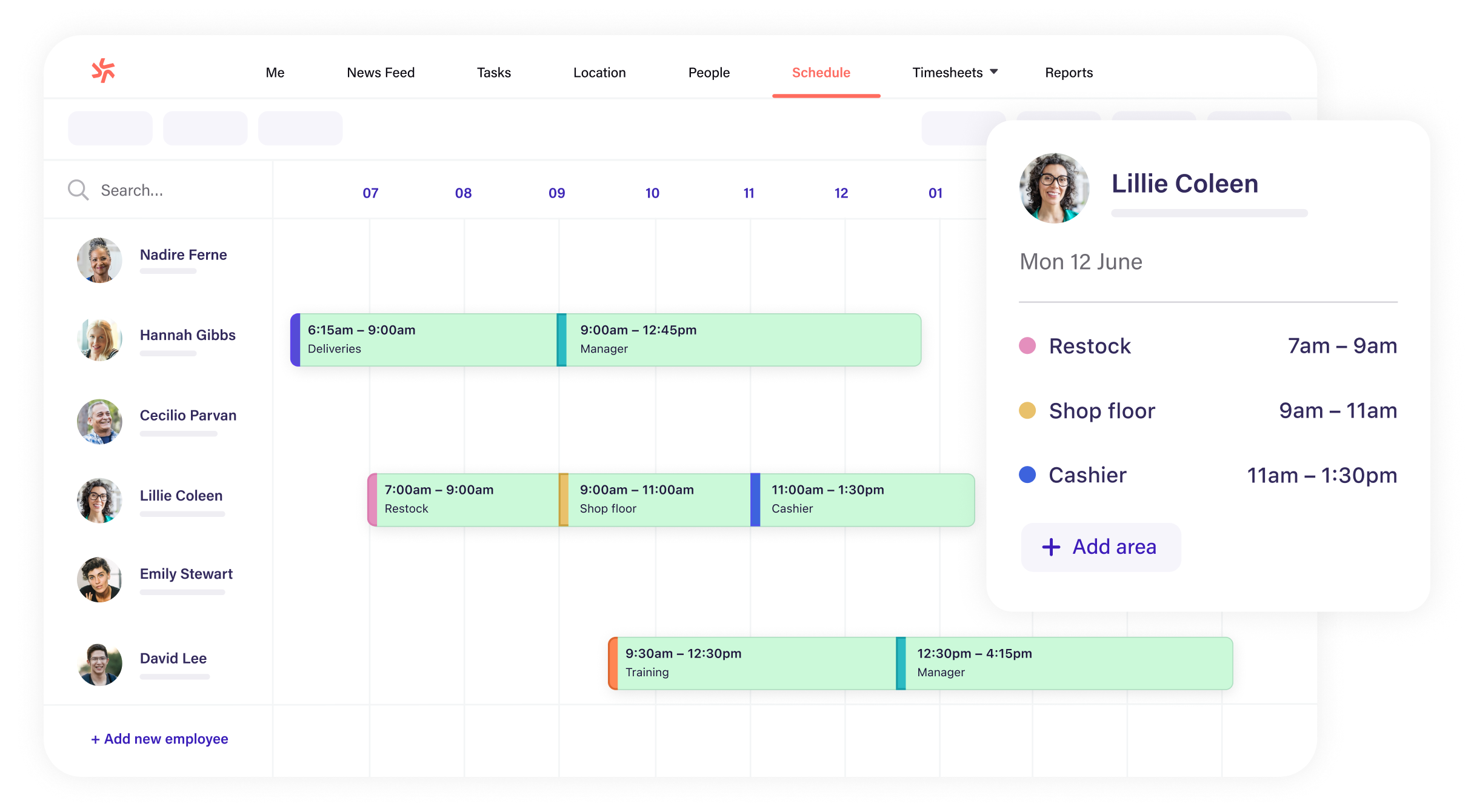

Micro-scheduling

Micro-shifts built to fit your business

Make every shift clear and manageable. Keep your team aligned, coverage consistent, and scheduling effortless.

Try the ultimate scheduling app today!

Powerful scheduling tools at your fingertips

Easy to use, all in one employee scheduling software that scales with your business.

Reduce wage costs

Accurately cost staff against sales data and never go over budget. Sync your employees' pay rates directly from your payroll provider.

Manage fatigue & overtime

Avoid employee fatigue by setting a limit on how many hours an individual can work per day or week. Part-timers can also have scheduled hours limited to avoid unnecessary overtime.

Simplify wage & hour compliance

Manage compliance with federal, state, and local laws - including fair workweek. Deputy helps streamline employee attestation, break compliance, and premium pay requirements.

Schedule by skillset

Schedule employees according to their skills and qualifications. Whether it’s first aid, food preparation, or heavy machinery, track staff skillsets and schedule accordingly.

Cover leave & unavailability

Our smart leave management system allows employees to independently request time off. Schedule more efficiently with clear, reliable availability and leave balance insights.

Monitor attendance & breaks

See when staff arrive on site, take breaks, and leave for the day. Missed or unscheduled breaks are flagged so you can proactively manage unexpected compliance risks.

Seamlessly connect POS and HR systems with our employee scheduling software

Sync employees from your HR software to build and maintain an accurate schedule. Our scheduling app also integrates with a host of other services that already manage your accounting, payroll, POS, data storage, and more.

Frequently asked questions

- What is Employee Scheduling Software?

Employee scheduling software makes it simple to create staff work schedules, effortlessly track employee hours, manage shift-swaps, control labor costs, reconcile timesheets, and improve communication and collaboration within teams. Anywhere, anytime, and on any device. The capability of web scheduling software also extends to prevent time theft, optimize staffing levels with live sales data, and help align labor requirements with sales forecasts to reduce wage bills.

- Why is Employee Scheduling Important?

Employee scheduling, and the software employers use to do it, helps you track time and attendance, improve team communication, schedule shifts, approve time off requests, and identify open shifts in seconds. It helps you stay on budget and cost-efficient.

- What Are Other Helpful Time Tracking Tools from Deputy?

We have a number of time tracking tools aside from our scheduling feature, including a time clock app, attendance tracking, and payroll integration. Schedule your team in minutes!

- How Many Employees Can You Schedule with Deputy?

You can schedule up to 100 shifts per month and approve up to 100 timesheets per month in our starter plan. If you're employees' scheduling needs go beyond those limits, we recommend you consider our premium or enterprise plans.

- How do I create a work schedule for my employees?

We discuss how to schedule your employees elsewhere, but some best practices for employee work schedules include keeping track of vacation time, knowing your employees, and prioritizing team communication.

- Can Deputy help schedule meal and rest breaks?

Yes! Deputy’s Break Planning feature allows you to schedule, manage, and track multiple employee breaks and break types in a single shift. This includes meal (unpaid) and rest (paid) breaks

- Will Deputy work with my other systems?

Absolutely. Our scheduling app has been built to function seamlessly with all sorts of accounting, HR, and point of sale software including Xero, Vend, and iPayroll. For a full list of integrations, click here.

- What is micro-scheduling?

Micro-scheduling enables a single employee to work in multiple segments or sub-shifts across different Locations and Areas in a single shift. Micro-scheduling in Deputy is a comprehensive feature suite that touches scheduling, time and attendance collections, and timesheet approval, making it easier for team members to know exactly what they're doing every shift.