Complying with time clock best practices for your nonexempt employees is key to operating a successful business. In fact, good timekeeping practices are critical for compliance with federal, state, and local wage and hour laws and regulations.

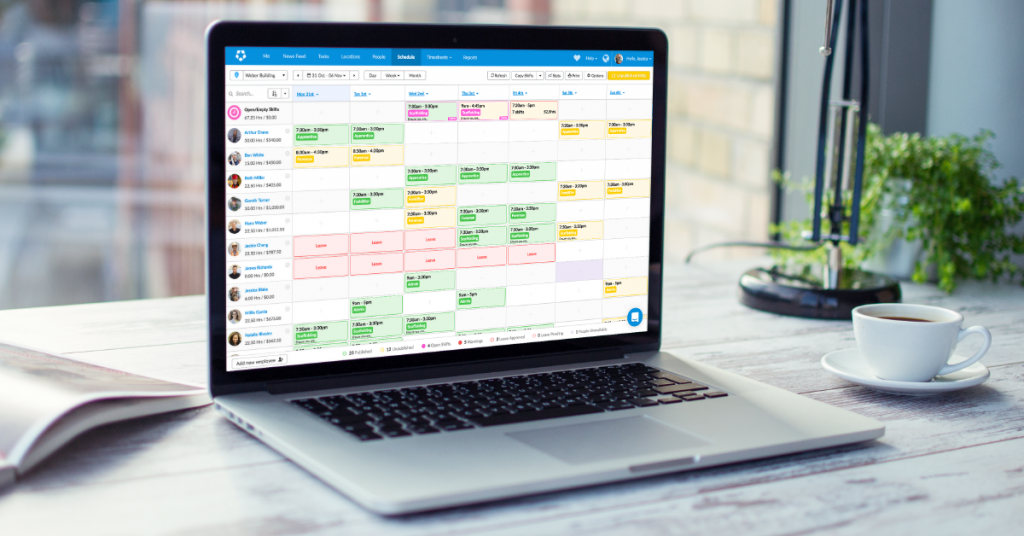

Implementing a workforce management system that includes advanced time clocking and tracking functions is one key way to help you accurately track your employees’ straight time and overtime hours worked, meal and rest breaks, and entitlement to premium payments when required.

Employee Time Recording Terms

Not sure where to start? Here are some keywords for employee time recording that you should know:

Exempt vs. nonexempt employees

When considering wage and hour requirements, it’s important to understand the distinction between exempt and nonexempt employees.

An exempt employee has exempt job duties and generally receives a predetermined salary which doesn't fluctuate based on the number of hours worked or the quality of work. Exempt employees aren't typically required to track their hours worked, and aren't generally entitled to meal breaks or overtime pay.

A nonexempt employee, on the other hand, can be paid in a number of different ways — a salary, an hourly wage, piece rate, or commissions. The key difference between a nonexempt employee and an exempt employee is the fact that a nonexempt employee is required to track their hours worked and their breaks, and they must be paid overtime pay for overtime hours worked.

The most effective way to track employee time is to use cutting-edge timekeeping software because as a manager, you schedule the number of hours that your nonexempt employees work. Some states and cities have passed predictive scheduling laws, also known as fair workweek laws, which requires advance notice of schedule changes be provided to eligible employees. So having accurate time is critical. For more information on predictive scheduling laws, check out this blog post.

You should check federal, state, and local laws regarding nonexempt workers and overtime pay. If the applicable laws specify different amounts of overtime pay, you must always apply the law that is the most favorable to your employee.

Being on-call for work

Requiring hourly employees to be on-call for work is a popular way to deal with changes in shifts in the retail, hospitality, and fast food industries. Being on-call for work means that an employee is available for work and must wait to be contacted by you about whether they need to attend work.

The New York City’s Fair Workweek Law has banned on-call scheduling for retailers because this practice makes it difficult for employees to organize facilities, like childcare.

For businesses that aren’t affected by predictive scheduling provisions, requiring employees to be on-call is a way of preventing over and under-staffing.

On-call pay for hourly employees

On-call pay for nonexempt employees occurs when the employee is paid for the time they spend making themselves available for work. Whether or not an employee is entitled to on-call pay depends on a complicated legal analysis that varies based on federal, state, and local laws. An employee is generally entitled to on-call pay if they're so restricted while being on-call that they can't effectively use the time for personal pursuits. This is a fact-intensive inquiry.

Nonexempt employees working off the clock

Under the FLSA, nonexempt employees must get overtime pay equivalent to (or more than) 1 ½ times their normal rate, for hours worked over 40 hours in a work week. It’s your responsibility to ensure that you’re not running afoul of the law by making sure that your hourly employees get overtime pay if they work more than 40 hours per week. In addition, some state laws have different overtime requirements (such as overtime pay for hours over 8 in a workday).

Some employers aren’t aware that they’re breaking overtime pay legislation because their nonexempt employees work off the clock. Working off the clock is when a nonexempt employee does tasks that are considered work without clocking in to record the tasks (for example, checking work email from home). The following are some examples of nonexempt employees working off the clock:

Changing into a uniform – Where your employees have to wait at the start (or end) of their shift to accept or hand in their uniform or other work gear, they may need to be paid for the time spent waiting.

Serving a customer – If your employee stays to help a customer when their shift ends, you may need to pay them for the extra time they spent with the customer.

Preparing for the beginning of the day/shift – In the instances where your employees come in early to set up your business (for example a barback setting up a bar), this preparation work must be paid.

Doing tasks after the business has closed for the day – In the event that your employees clock out and continue to do jobs to close your business at the end of the workday (for example, cleaning), you should pay them for this time.

Time clock best practices for nonexempt employees

Now that you know some of the key terms for timekeeping, here are a few time clock best practices for your nonexempt employees:

Time tracking system

You’re not obligated by the FLSA to use one type of time tracking system. You’re free to choose whichever system to track your employees’ time as long as it’s accurate. The system needs to record the employee’s actual hours worked including any breaks.

Protip: Use a touchless clock in system to allow employees to clock in and out for work without needing to touch the device — including to record breaks. Facial recognition and voice-activated commands are the most advanced way to record accurate timesheets while keeping your team healthy.

Rounding

Some laws may allow employers to round employees’ reported time up or down to the nearest specified increment so long as rounding goes both ways and doesn't result in underpaying the employee overtime. For example, if you’re rounding off in 15-minute increments and your employee finishes work at 6.11 p.m., some laws would allow the time to be rounded up to 6.15 p.m.

Your workforce management system should automatically round up and down to ensure accuracy and that your nonexempt employees’ time is rounded fairly. Interested in how much money your organization could be saving? Download this free ROI calculator.

Records

As an employer, you’re required to keep time cards (or any other records) that demonstrate how your hourly employees’ wages are calculated for several years. And, you must give the Wage and Hour Division access to inspect your records if necessary.

Your time clock management system needs to be capable of storing employee clocking in and out records for as long as is required by law. Additionally, it should also provide a feature that enables you to sort by different criteria for intuitive reporting.

Clocking in early and clocking out late

You should be able to control whether your nonexempt employees are allowed to clock in early or clock out late. The clocking time before and after your employees’ shift should only be a few minutes.

You also need to ensure that your employees are not working during this extra time. To avoid confusion, your time clocking system should allow you to place a limit on clocking in early and clocking out late.

Confirmation

Your nonexempt employees should have the opportunity to confirm the accuracy of their hours at the end of every pay period. Although your time clocking system will have recorded the time worked accurately, your nonexempt employees should still be given the chance to verify their hours.

Your time clocking system should also provide you or the scheduling manager with the functionality to auto-approve time cards with no variations. Additionally, you or the scheduling manager should receive automatic notifications if there are any irregularities with time cards. Use a workforce management system that flags anomalies with your employees’ hours to enable you or the scheduling manager to investigate.

Policies

You’re responsible for letting your nonexempt employees know about the policies and procedures for time clock usage. It’s recommended that you provide training and include timekeeping policies in the employee handbook. Policies that should be included are:

The actions that amount to attempted tampering with the clocking in and out system.

The consequences of trying to commit time theft.

What happens if employees try to clock in or out for their colleagues.

Invest in your business

Given the importance of adhering to time clock best practices, it may be difficult to satisfy legal requirements using manual time cards. Added to the potential legal issues of failing to calculate your nonexempt employees’ time accurately, you could also be losing money if your employees are not recording their time accurately.

Recording your employees’ time needs to be done efficiently to minimize the likelihood of errors. Deputy’s workforce management system isn’t just about making life easier for you and your employees in relation to time recording.

Try your free trial of Deputy to see how time clock management can be a breeze.