Navigate fair workweek laws and protect your business

- Create fair, profitable schedules in a few clicks

- Avoid penalties with compliance alerts

- Keep a secure record of compliance

America's leading scheduling software

What is fair workweek?

Fair workweek laws, also referred to as “predictive scheduling” or “secure scheduling”, require more than just early notice of employee schedules — and paying compensation for last-minute changes. Affected businesses in the below jurisdictions have other obligations, such as providing adequate rest between shifts and awarding open shifts to existing part-timers before hiring new staff.

The stakes around non-compliance are high and costly. In fact, U.S. businesses in cities with Fair Workweek laws paid more than $27 million in violations in 2022. Learn more on the pages below.

The go-to source for labor law updates in every U.S. state

To help businesses keep up with the latest labor law changes, our legal experts have created a breakdown of key laws in every U.S. state, including minimum wage.

How Deputy helps you stay compliant with Fair Workweek laws

Good Faith Estimate

Easily create a good faith estimate of regular work hours for your employees. Get visual warnings to prevent scheduling outside their good faith estimate or capture consent for working shifts outside the estimate.

Advance notice of schedules

Create fair and profitable schedules well in advance based on accurate demand forecasts. Minimize compensation payments for last-minute changes. Instantly publish schedules to your team via web or mobile.

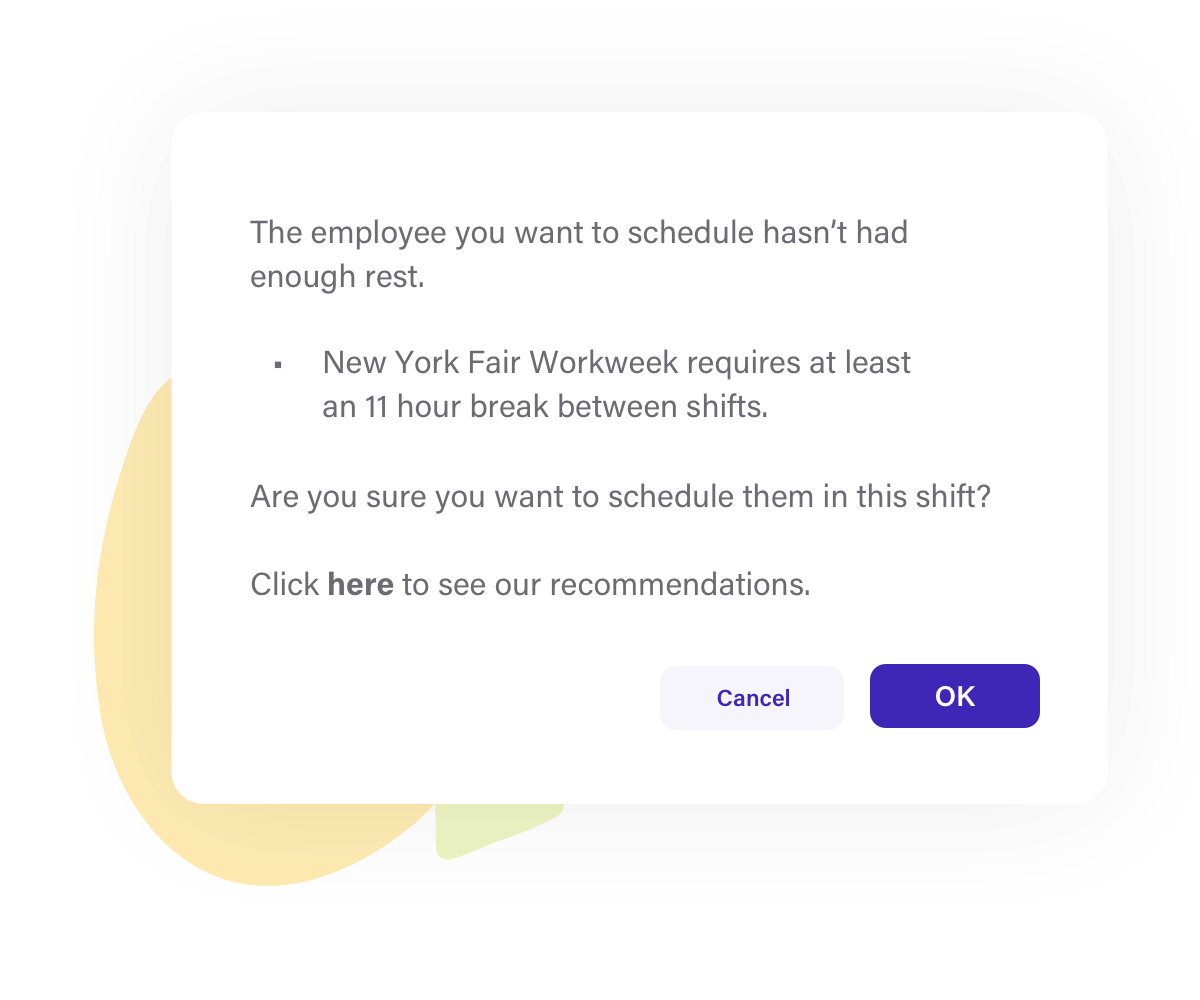

Consent for schedule changes and clopenings

Avoid penalties with compliance alerts. Managers get warnings when schedule changes require consent and predictability pay. Deputy will also alert you when staff are at risk of clopening. If staff are willing to work clopening shifts, Deputy will capture and store a record of consent.

Predictability pay

Our visual flags will alert managers to schedule changes that will incur predictability pay. If changes are unavoidable, automatically get the right premium and apply it to employee timesheets.

Access to hours

Create open shifts that can be shared via email, text, or mobile app notifications to existing employees. Employees can claim shifts through mobile app or the web. Managers can approve when shifts are claimed and post a notice of available shifts for all suitable staff on our News Feed.

Record of compliance

Deputy offers Fair Workweek reports that track schedule change history, consent, and predictability pay. Easily access digital records whenever auditable records are needed and prevent pay disputes down the line.

- Understand if Deputy is right for you

- Ask any burning questions

- Learn what our software can do

Fair Workweek insights and resources

Frequently asked questions

- How does Deputy help with Fair Workweek compliance?

With Deputy, businesses can easily manage scheduling processes and simplify compliance with Fair Workweek ordinances.

Our solution offers several benefits, including increased efficiency, improved communication, predictability pay calculations, the opportunity to offer work to existing employees, and customizable settings, all of which can help business owners and managers simplify compliance with these complex laws.

- Which states are under the FLSA laws?

Alabama, Arkansas, Arizona, Connecticut, Delaware, Florida, Georgia, hawaii, Idaho, Illinois, Indiana, Iowa, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada (without daily overtime), New Hampshire, New Jersey, New Mexico, New York (miscellaneous industries), North Dakota, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermin, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

- Which compliance laws do Deputy help businesses stay compliant with?

Our software makes it simple to manage meal and rest break laws, the Fair Labor Standards Act (FLSA laws), minimum wage, overtime, premium pay, child labor laws, leave law compliance, fair workweek, and occupational safety and health administration requirements (OSHA).

Disclaimer

The information provided in this publication is for general informational purposes only. Deputy makes no representations or warranties of any kind, express or implied, with respect to the software or the information contained in this publication. While, Deputy’s software is designed to simplify shift work by assisting with hiring, onboarding, scheduling, time and attendance tracking, payroll integration, and wage and hour compliance, it is not a substitute for payroll or legal advice, nor is it intended to relieve you of your obligation to comply with the legal requirements applicable to your business. It is ultimately your responsibility to ensure that your use of Deputy complies with all applicable laws and regulations. Please review our Product Specific Terms for more information about your compliance responsibilities.